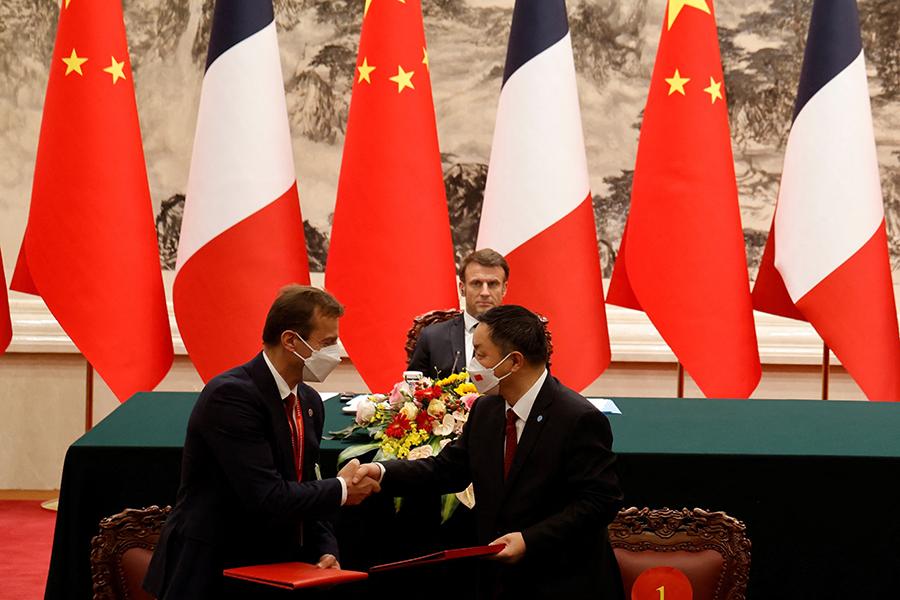

Airbus CEO Guillaume Faury shakes hands with his Chinese counterpart as French President Emmanuel Macron looks on during his state visit to Beijing on April 6, 2023.

Credit: Ludovic Marin/AFP/Getty Images

Airbus will add a second final assembly line (FAL) at its site in Tianjin, China, doubling capacity at its Chinese plant. The announcement was made April 6 during the state visit of French President Emmanuel Macron to Beijing with Airbus CEO Guillaume Faury part of France’s delegation. Faury signed...

Subscription Required

This content requires a subscription to one of the Aviation Week Intelligence Network (AWIN) bundles.

Schedule a demo today to find out how you can access this content and similar content related to your area of the global aviation industry.

Already an AWIN subscriber? Login

Did you know? Aviation Week has won top honors multiple times in the Jesse H. Neal National Business Journalism Awards, the business-to-business media equivalent of the Pulitzer Prizes.