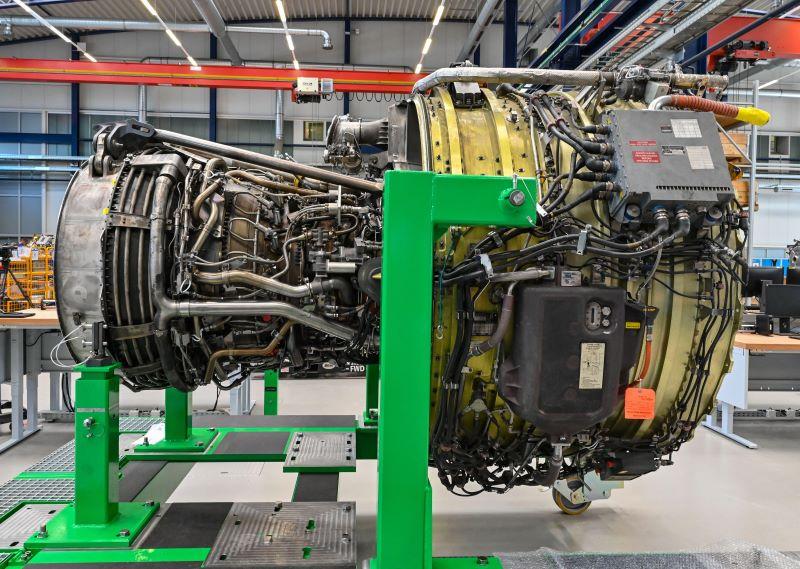

Credit: dpa picture alliance / Alamy Stock Photo

Judging by the industry’s reaction to the ongoing AOG Technics paperwork scam, the threat of criminals being criminals is not enough to drive major changes in how airline parts are procured, tracked, and validated. At Aviation Week’s recent MRO Americas event, representatives of both airlines and...

Subscription Required

This content requires a subscription to one of the Aviation Week Intelligence Network (AWIN) bundles.

Schedule a demo today to find out how you can access this content and similar content related to your area of the global aviation industry.

Already an AWIN subscriber? Login

Did you know? Aviation Week has won top honors multiple times in the Jesse H. Neal National Business Journalism Awards, the business-to-business media equivalent of the Pulitzer Prizes.