CAPA Perspective: LCCs Make North Atlantic Gains

Eurowings Discover is one of four LCCs that have recently entered the North Atlantic market.

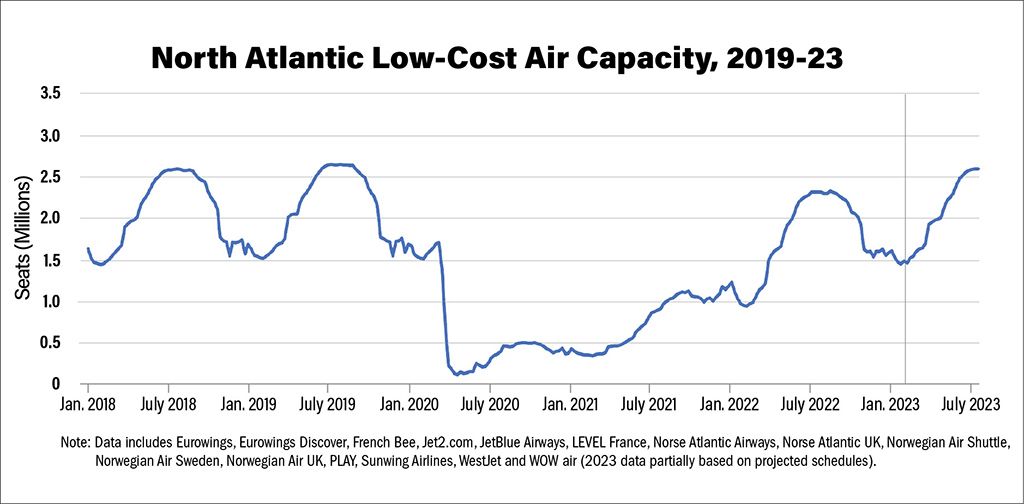

The first quarter of 2023 has seen capacity in the North Atlantic market approaching pre-pandemic levels. However, the low-cost segment has reached only about half of where it stood in 2019. Nevertheless, this masks a renewed dynamism in the North American-European low-cost market, which has undergone a reboot since the depths of the COVID-19 crisis.

Three LCCs left the North Atlantic market in 2019 and 2020: WOW air, Norwegian and Eurowings. But there have been four new entrants since 2021: JetBlue, Eurowings Discover, Norse Atlantic and PLAY.

Low-cost seat share in the North Atlantic is projected to grow to more than 4% in the first six months of 2023 after falling to zero two years earlier. During the first phase of low-cost disruption that began in 2013, it took four years for LCC share to exceed 4%, before reaching a peak of more than 8% in 2018.

LCC gains in seat share are mainly at the expense of nonaligned airlines. The immunized North Atlantic joint ventures (JV), such as between American Airlines and British Airways; United Airlines and Lufthansa; and Delta Air Lines and Air France-KLM and Virgin Atlantic, are so far holding steady in terms of market share.

According to CAPA data, seat capacity on the North Atlantic increased 1.3 times in 2022, taking it to 84% of where it was in 2019.

Based on projections derived from airline schedules, growth for the first six months of 2023 will be 23.5% year-on-year, taking capacity to 98% of its size for the same period in 2019.

LCC seat numbers on the North Atlantic, meanwhile, increased by almost nine times in 2022 compared with 2021, but LCC capacity remained at only 37% of its 2019 level.

LCC capacity for the first half of 2023 is projected to increase 2.5 times compared with the same period in 2022. This will take it to just over half its 2019 first-half size (53%). Meanwhile, non-LCC capacity for the 2023 first half is projected to exceed its 2019 first-half levels by just over 1%.

Climbing Back

Although LCC capacity has been slower than non-LCC capacity to recover its pre-pandemic level on the North Atlantic, it is now building back rapidly. LCC seat share was 7.2% in 2019, which was a little below its 2018 peak of 8.1%.

The low-cost, long-haul market between Europe and North America almost entirely closed during the pandemic, but LCC seat share is projected to be 4.2% in the first half of this year, compared with virtually zero for the same period in 2021 and 2.1% in 2022.

After Norwegian entered the North Atlantic in 2013, it took four years for LCC seat share to exceed 4%. WOW air collapsed in 2019, and Norwegian and Eurowings left the long-haul market in 2020.

Many observers declared that the low-cost, long-haul model had failed and would not reestablish. Yet, according to CAPA data, while there will be 34 North Atlantic routes operated by LCCs in summer 2023, which is only one more than in summer 2022, low-cost seat capacity will be 43% higher in the last week of June. For the whole of the first half of 2023, low-cost capacity will be up by 150% year-on-year.

The impact of the first wave of LCC entry on the immunized JVs on the North Atlantic was to erode their seat share. Combined JV share fell from 82.2% in 2014 to 72.7% in 2018, the year that LCC share peaked at 8.1%.

However, the JV airlines regained some of their market share losses following WOW air’s demise before the pandemic and Norwegian’s exit from the North Atlantic market during the pandemic. JV share reached 79.6% in 2021, in a much-reduced market, before slipping fractionally to 79.4% in 2022. It is projected to be 79.7% for the first six months of 2023, so the JV airlines remain a significant force, and the increase in LCC share has mainly been at the expense of airlines that are neither LCCs nor in immunized JVs.

This latter category is projected to have 16.1% of North Atlantic seats in the first half of 2023, down from 17.1% in the same period a year earlier and 19%-20% throughout the period 2016-2021.

It is broadly accepted that LCCs, particularly Norwegian and WOW air, grew too quickly in the first phase of LCC market entry into the North Atlantic. A more measured approach, spread more evenly among more operators, may help to build a more robust, sustained low-cost segment.