If Korean Air’s acquisition and integration plan for Asiana Airlines stays on anticipated timelines, Seoul is expected to return to having a single home-based international carrier within about three years. The new Korean Air will be a significantly reorganized airline in a reshaped industry.

For almost 40 years of its 52-year history, Korean was the country’s only major international carrier. The scene changed in 1990 when Asiana launched its first scheduled international flights to Japan, quickly adding service in 1991 to Hong Kong, Singapore, Taiwan and Thailand before launching its first transpacific route, to Los Angeles, at the end of that same year. Asiana’s expansion was rapid. By 2019, it was serving more than 70 destinations in 23 countries as well as 12 domestic cities, accounting for 25% of Korea’s international market and 20% of its domestic market.

Growth did not lead to profitability, however, and by 2018, the airline was in financial crisis. Parent company Kumho Group made clear it was looking to divest Asiana, but various acquisition deals failed to materialize in 2019. As the pandemic crisis took hold and worsened in 2020, a deal emerged in November in which Korean would acquire Asiana for KRW1.8 trillion ($1.6 billion), with state-owned Korea Development Bank investing KRW800 billion to support the acquisition.

The deal requires approval of business combination reports to nine countries as well as a sign-off from the Korean Fair Trade Commission. The expectation is that this process will take until the end of 2021, allowing the acquisition to be completed, after which there will be an integration process of about two years. Korean will remain a subsidiary of holding company Hanjin KAL, while Asiana will become a subsidiary of Korean.

For Korean’s senior leadership team, the deal means steering the beginnings of what will be a massive integration exercise while also managing the company through the pandemic crisis. President Woo Keehong, in an interview conducted via email, provided detailed insights into how that will be achieved and his priorities.

For anyone questioning the rational of such a major investment and inevitable upheaval during aviation’s worst-ever crisis, Woo has a clear answer: Excessive competition was hurting both airlines and was neither sustainable nor good for Korea’s aviation industry.

“Even before the pandemic, Korea’s network airlines, as well as the entire aviation market, had started to be affected by excessive competition and the situation was even worse for Asiana,” he said. “As more low-cost carriers jumped into the market, the competitiveness of both airlines was weakened on medium- and short-haul routes.

“Under the circumstances, we concluded it was hard to guarantee long-term survival without the restructuring of Korea’s aviation market. Accordingly, we decided to acquire Asiana to stabilize the industry and protect jobs by maintaining networks and strengthening the competitiveness of Incheon International Airport as a major hub.

“Our decision to acquire Asiana was based on the pursuit of our core mission to contribute to the global aviation community and support the advancement of Korea’s aviation industry.”

But Woo does not see the combined Korea-Asiana making much difference in terms of competitiveness against other major internationals, especially those in Asia.

“Korean and Asiana’s slots at Incheon represent less than 40% when combined,” he explained. “Singapore Airlines and Cathay Pacific, which each represent one major flag carrier at their hub airports, have secured more frequencies on Incheon-Singapore and Incheon-Hong Kong routes than Korean or Asiana.”

Where Woo does see competitive advantages coming out of the acquisition is through Korean’s larger size, being able to supply similar seat capacity to those other single major flagships, and being able to adjust operation times and increase connectivity through Incheon.

“We expect that economies of scale through integration will enhance asset utilization, including fleets, and generate synergies of KRW300 billion to KRW400 billion per year through more effective workforce management and improved efficiency,” Woo said.

Operating profit

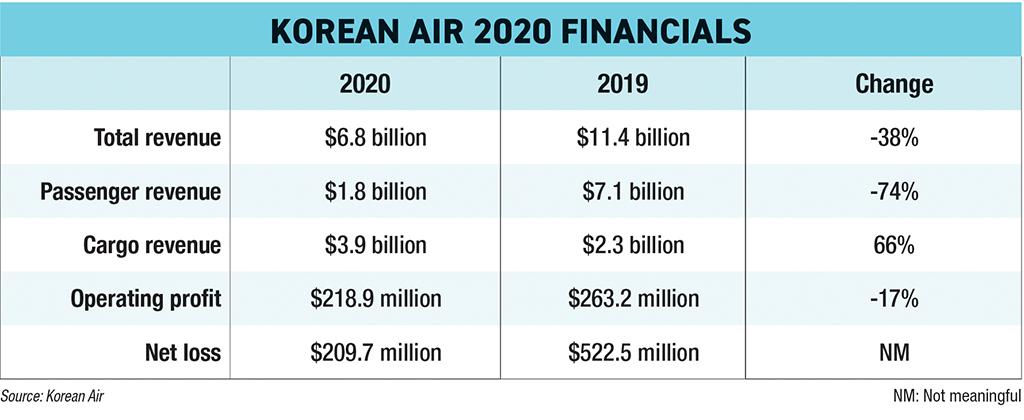

In another advantage, and unlike many international carriers in 2021, Korean entered this year in a relatively strong financial position, giving it an essential sound footing for the acquisition and integration process. For the full 2020 year, the company posted an operating profit of KRW238.3 billion ($219 million) on revenues of KRW 7.4 trillion. The airline’s net loss of KRW228.1 billion was a substantial improvement on the KRW568.7 billion net loss of the previous year, a remarkable achievement in the context of the pandemic.

A rapid expansion of its cargo business—where the airline increased sales by 66% and operated more than 9,000 freight-only flights in 2020—was a significant contributor to those results, but Woo also points to other steps that he describes as “self-rescue measures,” including spinning off the company’s inflight catering and duty-free business units, issuing new shares to reduce debt ratio and raise KRW3.3 trillion of capital, and deferring aircraft deliveries.

The positive trends continued in the 2021 first quarter. In mid-May, Korean posted an operating profit of KRW124.5 billion on revenues of KRW1.75 trillion. Cargo revenues for the quarter doubled, relative to the 2020 first quarter, to KRW1.35 trillion.

“The commitment of Korean Air’s employees to reduce costs cannot be emphasized enough,” Woo told ATW. “About 55% of our 8,000 to 9,000 employees working in Korea continue to go on rotational leave each month and help minimize costs.”

That employee commitment, Woo points out, meant that Korean did not lay off a single employee involuntarily last year.

As they work through the disruptions and uncertainties caused by the pandemic, “Team Korean Air,” as Woo affectionately refers to the airline’s 20,000 employees worldwide, now also faces potential upheaval and changes from the integration—as do the Asiana employees. Woo acknowledges the companies have different management practices and corporate cultures and says those will be analyzed “from the moment Asiana becomes Korean Air’s subsidiary until complete integration.”

That will not be a one-way exercise. “As we proceed with integration, we will proactively communicate with Asiana and accept Asiana’s strengths to establish a harmonious and robust culture,” Woo said.

“If we ensure fair recognition and opportunity with reasonable reward and compensation for all employees, I am confident we can overcome the challenges and we can benefit from our differences and create a compatible culture.”

Fleets and alliances

On the fleet side, Korean and Asiana operate 10 aircraft types—the Airbus A380, A350, A330, A320 and A220; and the Boeing 747, 777, 767, 787 and 737—with different engines, IFE systems and seat configurations. Woo says the combined fleet will need to be simplified after integration, but he expects that process to take more than five years to complete. Korean also placed new orders for the A321neo, 787-10 and 737 MAX before the pandemic and is in discussions to reschedule deliveries. With the A380s, of which Korean has 10 and Asiana six, Woo is more optimistic than some airline execs who have announced plans to sell or retire their aircraft post-pandemic.

“I believe the A380 will become more valuable as travel demand recovers,” Woo says. “After integration, it will be possible to operate A380s on routes such as JFK, LAX and SFO. We can also adjust fleet operations on other routes by monitoring the trends of increasing demand.”

Alliance-wise, Korean is a SkyTeam founding member while Asiana is with Star. After Asiana is incorporated as a Korean subsidiary, discussions will start to develop a plan for Asiana to exit Star, Woo said.

“When Asiana is fully integrated, we will naturally become a new, bigger Korean Air and a SkyTeam member of greater size that won’t require a separate process [for Asiana’s incorporation],” Woo said.

That “bigger” is a key component to the acquisition strategy. Post integration, Korean expects to increase its global stature, moving from being one of the world’s 20 largest carriers to a top 10 airline. In many ways, however, Korean was already on that path, leveraging Incheon as a northeast Asia global hub and its joint venture with SkyTeam partner Delta Air Lines—the two airlines are co-located in Incheon’s Terminal 2.

Alongside its financials, Korean had other indicators in 2020 of an upward trajectory. The airline gained a SkyTrax 5-star certification, the top ranking for customer service, that puts it in a club of just 11 carriers that includes Asiana, All Nippon Airways, Cathay Pacific, Eva Air, Garuda Indonesia, Hainan Airlines, Japan Airlines, Lufthansa, Qatar Airways and Singapore Airlines. Korean was the only new entrant last year.

The airline was also one of the first to trial the IATA Travel Pass system that enables COVID testing and vaccination records to be verified for international travel.

“The convenience and credibility of digital health documents can accelerate the resumption of international flight operations and be a milestone to resuming international travel,” Woo said. “It’s important to implement a credible digital health documentation platform, like IATA’s Travel Pass, to minimize the inconvenience and the risk of forgery.”

Looking ahead on travel resumption trends, Woo says he expects demand to return in the second half of the year as vaccination rollouts speed up, more travel bubbles are created and immigration restrictions are eased.

“Demand on US and Europe routes is expected to recover faster than other regions because the US and European countries lead the world in vaccination rates and 75% of populations in those regions are expected to be completely vaccinated by October this year,” he noted.

“Business demand is currently limited to essential technicians and professionals for relocation, but as COVID-19 comes under control and country entry restrictions are eased, we expect the MICE [meetings, incentives, conferencing and exhibitions] demand also will increase. But we don’t expect full travel demand recovery to the level of 2019 until at least 2024.

“In the case of tourism demand, it may take time for all the tourist destinations to be fully normalized. Travel demand is expected to first pick up focusing on COVID-clean countries and isolated vacation spots, where people can avoid contact with others as much as possible.”

Rising oil prices could partially offset some of the travel demand gains and is a concern, Woo acknowledges.

“As of the end of April, the West Texas Intermediate oil prices were $65 a barrel, up about 65% from the average price ($40 a barrel) in 2020,” he noted. “If business volume remains at its current level for the rest of the year and oil prices continue to rise (assuming the average unit price rises from 155 cents a gallon in the first quarter to 200 cents later this year), our operating fuel costs will be estimated at KRW1.7 trillion, an increase of 30% compared to last year. We are concerned that it will give a direct impact on our performance, adding at least KRW400 billion in overall costs.

“However, we plan to minimize the impact by increasing profits and reducing costs over the remaining period. For example, we have removed the seats of some passenger aircraft, carrying only cargo in the lower deck, to reduce weight and save fuel costs.”

But Woo clearly feels good about where Korean is headed.

“Amid the unprecedented crisis faced by the global aviation industry, the decision to acquire Asiana has provided a stimulus to restructure the Korean aviation market to enhance its global competitiveness and secure long-term growth. Even in the global stage, it is certainly one of the biggest deals since the pandemic for the sake of the global aviation industry,” he said.

“The solid commitment and support from our employees has made me feel so proud of being a member of Team Korean Air. It convinced me that we can become one better airline by combining two airlines successfully.”