What A Free Aviation Market Has Done For European Travelers

It may be difficult for younger Europeans to imagine how much the aviation market has changed since the days before European air transport liberalization, when there were only around 600 intra-European routes, fares were high and there were far fewer airlines to choose from. Most routes were operated by expensive national carriers.

The effects of a free aviation market cannot be understated. In 2001, Irish ultra-LCC Ryanair had just 35 routes; this has since grown to over 2,000. And the cost of flying from London to Dublin has fallen by 75%. Today, there are over 4,500 connected airport pairs within the region.

Capacity data provided by OAG shows the impact of liberalization on Europe’s air links, the growth of LCCs and overall competitiveness. For this analysis, data from a single week in April 2023 is used. Clearly this is not truly representative, and the timing is not ideal as it was an Easter holiday in Europe, but airlines are finally emerging from the pandemic and this recent data gives a good indication of where the industry stands now and is headed.

In terms of competition, the introduction of liberal market conditions provided the platform for LCCs to enter the market. In 1995, only one “real” LCC operated in Europe: Ryanair. Between 1995 and 2011 this all changed, with 110 new LCCs being established in Europe. Today, there are 40 airlines that might describe themselves as LCCs or ultra-LCCs in Europe, although these are dominated by Ryanair, UK-based easyJet and Hungary-based Wizz Air.

Of course, the business models of these carriers have adjusted over the past 30 years, with some, such as easyJet, offering a much closer product to their full-service competitors, while Ryanair’s business approach remains largely unchanged: low costs and low fares to maximize passengers and profit.

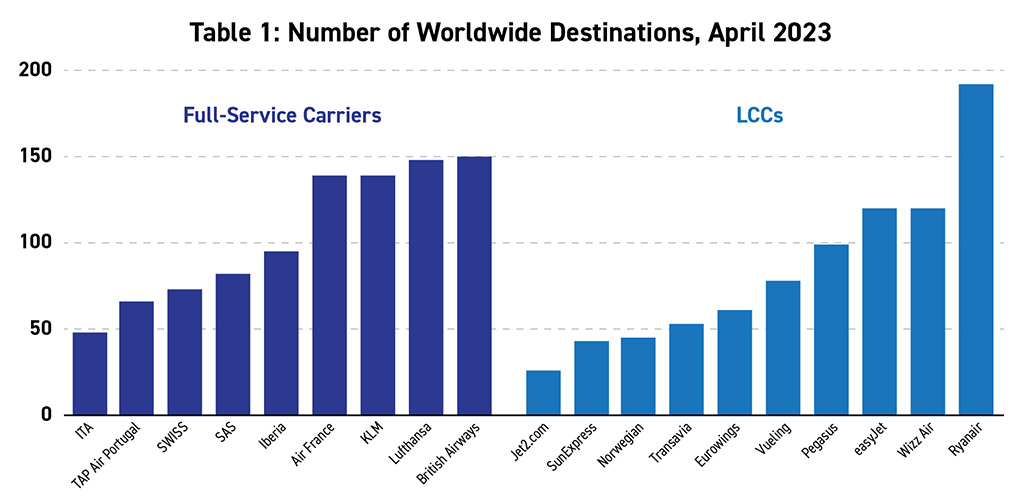

Table 1 illustrates the number of worldwide destinations served by Europe’s largest LCCs and full-service airlines. This shows that Ryanair now dominates the market, with the highest number of destinations/airports served.

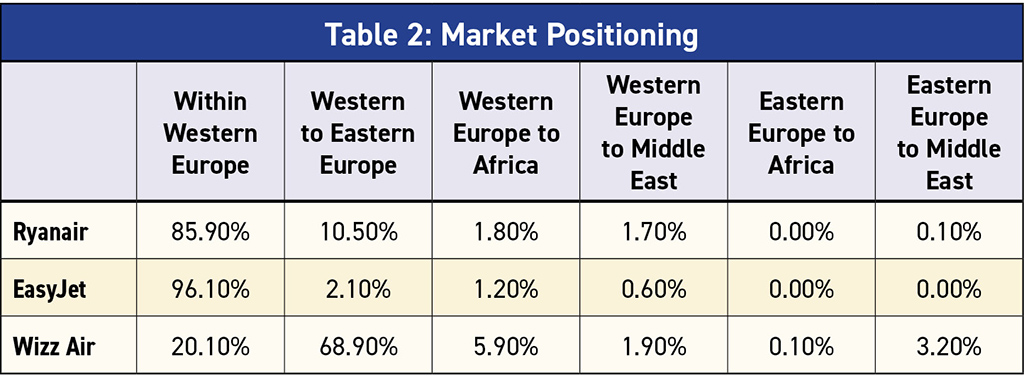

More recently, LCCs have stretched into countries beyond Europe, including Egypt, Israel, Morocco, Saudi Arabia, Tunisia and the UAE. However, these forays into “overseas” markets are limited. Just 3% of Ryanair’s operations terminate outside of the European Union, while for easyJet the proportion is only 2%. In terms of market positioning, easyJet is focused nearly exclusively on Western Europe, while Ryanair has grown its west-to-east market. Wizz has a more widespread network and is somewhat of an anomaly, with around 10% of its routes starting or terminating in Africa or the Middle East (Table 2).

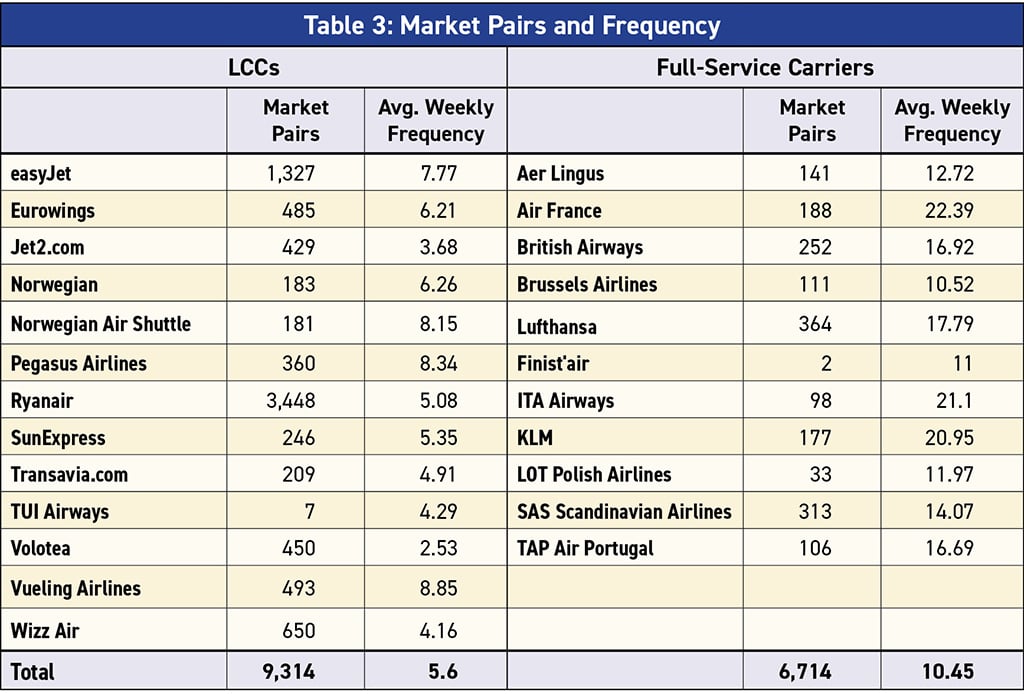

Looking at average weekly frequency (Table 3) gives an important indication of the type of service offered by LCCs and full-service airlines in Europe. Perhaps unsurprisingly, LCCs tend to offer about half the weekly frequency (per route served) of their mainline competitors. The exceptions are easyJet, some leisure operators and Spain-based Vueling.

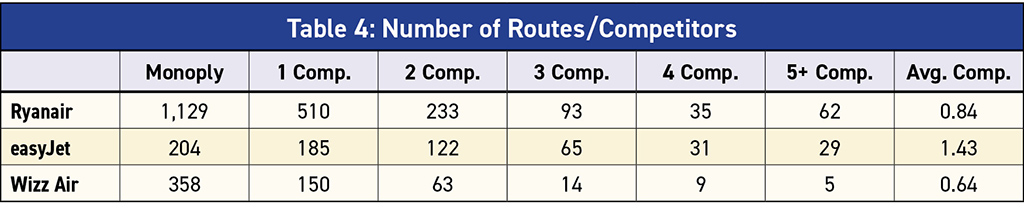

Table 4 shows the average number of competitors faced by Ryanair, easyJet and Wizz. EasyJet’s strategy of going head-to-head with full-service airlines means they have greater competition on most routes, while Wizz’s “under the radar” strategy in Eastern Europe mirrors Ryanair’s position in 2005-10. The saturation/maturation of the Western European market means that Ryanair now faces more competition than it once did.

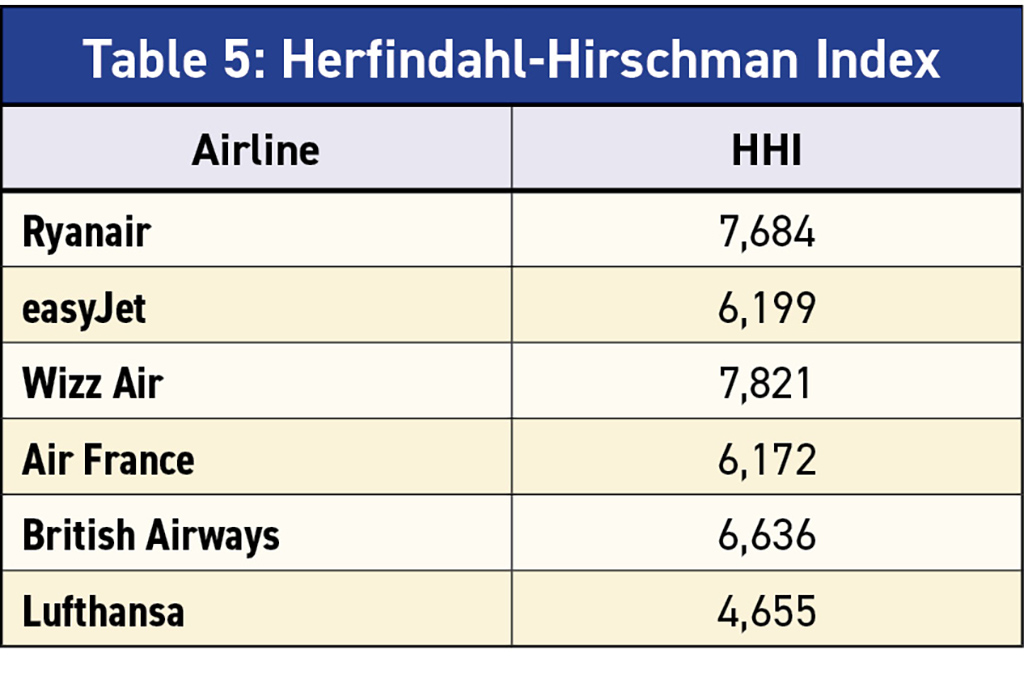

To examine whether the market has become more (or less) competitive over time, the Herfindahl-Hirschman Index (HHI) was used to assess the city-pair markets for all the routes operated by these three LCCs, and some of their full-service competitors. HHI assesses the number of competitors and their respective market shares. The higher the HHI value, the lower the competition. The highest possible value is 10,000, where there is no competition. Table 5 shows the levels of competition, at city-pair level, for some key players. On more that 60% of its routes, Ryanair is the only operator. The number of routes where easyJet is the only player stands at around 30%. On over half of easyJet’s routes, the carrier is in competition with other operators.

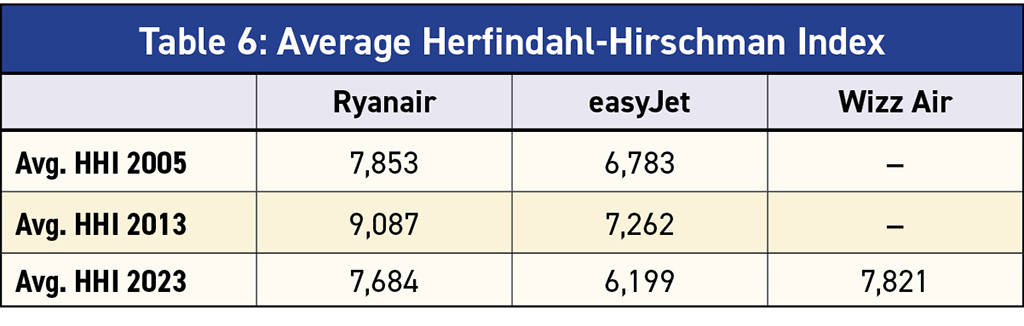

It is interesting to look at how competition has evolved over time. Table 6 shows that the competition faced by Ryanair reduced considerably between 2005 and 2013. During this time, Ryanair created new markets that network carriers would not consider, and LCCs avoided these routes because Ryanair was becoming dominant in the sector. Meanwhile, easyJet has always had a lower average HHI, as it tries to compete in larger and more competitive trunk-route markets—competing with both full-service carriers and other LCCs. In the 10 years since 2013, both Ryanair and easyJet have seen an increase in competition, particularly from new entrants like Wizz and Turkey-based Pegasus, especially as the market has trended towards saturation.

Keith Mason is professor of air transport management at Cranfield in the UK, where he lectures in air transport economics, airline business models and airline marketing to graduate students.