As the efficient use of airspace, runways and fuel requires aircraft to follow increasingly precise trajectories, satellite navigation equipment is becoming a must-have in civil aviation.

That was the rationale when the European Commission (EC) created the European Geostationary Navigation Overlay Service (EGNOS) in the 2000s. The reasoning behind augmenting the GPS signal and making it reliable and accurate enough for commercial air transport remains valid. But airframers and carriers initially dragged their feet, only seeing the needed aircraft equipage as an additional cost.

- EGNOS set to become dominant navigation aid by 2030

- GPS-to-Galileo swap is considered for the long term

While that attitude eventually softened, they no longer have a choice. The EC ruled that EGNOS should be the basis for every runway approach procedure by 2030, requiring the industry to move quickly toward wide use of Europe’s satellite-based augmentation system (SBAS).

The rule references performance-based navigation (PBN) in Europe, and using EGNOS is the only way for an aircraft’s flightpath to reach the level of precision PBN requires. As a result, a Category 1 precision approach procedure will be available for every runway with a published instrument (as opposed to visual) approach procedure. That stage is planned for 2024, and 2030 is the goal for other procedures to disappear.

As an exception, instrument landing systems (ILS) will be maintained where they provide Cat. 2 and Cat. 3 approaches, such as at airports where access must be preserved even in rare very poor visibility conditions.

Air navigation service providers (ANSP) in Europe expect major cost savings. The annual maintenance of an ILS is estimated to be more than €50,000 ($60,000). Installing a new ILS involves major civil engineering work—France’s ANSP, DSNA, is spending €3 million at Nantes Atlantique Airport.

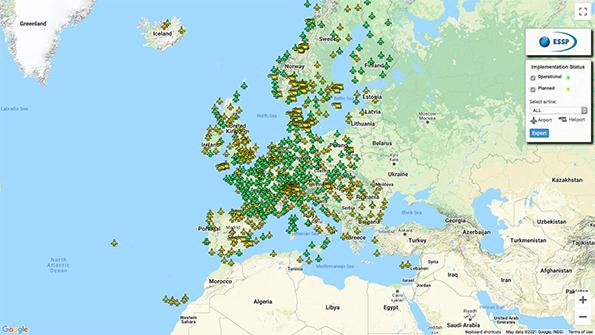

EGNOS is an EU program administered by European Satellite Services Provider, which is owned by the ANSPs of seven countries: France, Germany, Italy, Portugal, Spain, Switzerland and the UK. They all have a vested interest in seeing EGNOS adopted and ground infrastructure reduced.

DSNA, in particular, manages about twice as many runways with an instrument approach as Germany or the UK. DSNA has acted with relative urgency—50 of its 100 ILS Cat. 1 installations have been decommissioned, or are just about to be decommissioned, thanks to the publication of EGNOS approaches, says Benoit Roturier, DSNA’s program director for satellite navigation.

Reducing the size of the ILS network has already translated into significant savings for DSNA: €5 million per year, or one-third of the annual budget for navigation equipment, says Roturier.

DSNA is keeping its 30 ILS Cat. 3s. In addition, a minimal operating network (MON) has been defined in case satellite service is lost on a large scale. ILS Cat. 1s are to be kept at 38 airports.

Other ground-based navigation aids—very-high-frequency omnidirectional range (VOR) and nondirectional beacons (NDB)—are being decommissioned too, as part of the MON strategy. The number of VORs is being cut to 51 by 2030, from 84. NDBs are being eliminated.

Between 2000-2010, SBAS promoters faced opposition from Airbus and Boeing, which were instead betting on other means of navigation, Roturier says. This explains the relatively low proportion of equipped aircraft. Air traffic control statistics at Nice Cote d’Azur Airport, for instance, show less than 20% of aircraft landing there were equipped for EGNOS-aided approaches in early 2020.

Airframers and carriers seem to be embracing the principle of EGNOS. Airbus has designed a display in which the landing system is identified (typically ILS, SBAS or ground-based augmentation), but the human-machine interface looks like an ILS. Air France’s policy is to retrofit SBAS receivers into its fleet as soon as possible.

EGNOS promoters are beginning to turn their attention to the Galileo constellation, Europe’s counterpart to the U.S. GPS. Next year, Galileo will meet the International Civil Aviation Organization’s standards, Roturier says.

Some system manufacturers have begun development of a Galileo receiver, says Jean-Marc Pieplu, head of the EGNOS services department at the EU Agency for the Space Program (EUSPA). “Certification looks possible in 2024,” he says.

In the future, the EUSPA may spur such work as part of the EC’s sovereignty efforts, so EGNOS may ultimately be able to augment both GPS and Galileo signals.