IATA: Asian, South American and African destinations to see fastest growth in new routes

Asian, South American and African destinations will see the fastest growth in new air services, said International Air Transport Association (IATA) in its recently published updated passenger growth forecast, reflecting economic and demographic growth in those markets.

IATA projects that passenger numbers are expected to reach seven billion by 2034 with a 3.8 per cent average annual growth in demand (2014 baseline year). That is more than double the 3.3 billion who flew in 2014 and exactly twice as many as the 3.5 billion expected in 2015.

Previously, IATA forecast 7.4 billion passengers in 2034 based on a 4.1 per cent average annual growth rate. The revised result reflects negative developments in the global economy that are expected to dampen demand for air transport, especially slower economic growth projections for China.

Indonesia-East Timor will be the fastest growing route, at 13.9 per cent, followed by India-Hong Kong (10.4 per cent), within Honduras (10.3 per cent), within Pakistan (9.9 per cent) and United Arab Emirates-Ethiopia (9.5 per cent).

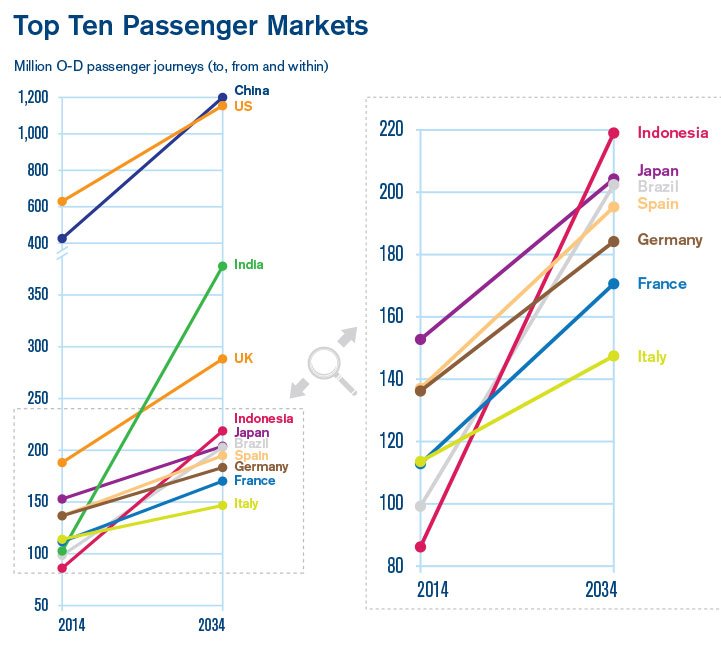

The five fastest-increasing markets in terms of additional passengers per year over the forecast period will be China (758 million new passengers for a total of 1.196 billion), the US (523 million new passengers for a total of 1.156 billion), India (275 million new passengers for a total of 378 million), Indonesia (132 million new passengers for a total of 219 million) and Brazil (104 million new passengers for a total of 202 million).

Seven of the ten fastest-growing markets in percentage terms will be in Africa. The top ten will be: Malawi, Rwanda, Sierra Leone, Central African Republic, Serbia, Tanzania, Uganda, Papua New Guinea, Ethiopia and Vietnam, according to IATA. Each of these markets is expected to grow by 7-8 per cent each year on average over the next 20 years, doubling in size each decade.

However, while the demand for air transport continues to grow, there is still much work to be done to prepare for the seven billion passengers expected to take the skies in 2034,” according to Tony Tyler, Director General and Chief Executive Officer, IATA.

“Economic and political events over the last year have impacted some of the fundamentals for growth. As a result, we expect some 400 million fewer people to be travelling in 2034 than we did at this time last year,” said Tyler.

“Air transport is a critical part of the global economy. And policy-makers should take note of its sensitivity. The economic impact of 400 million fewer travellers is significant. Each is a lost opportunity to explore, create social and cultural value, and generate economic and employment opportunities. It is important that we don’t create additional headwinds with excessive taxation, onerous regulation or infrastructure deficiencies,” he added.

Looking more closely at the numbers and it is evident that a sizeable gulf has opened up between the performance of air passenger markets in the BRIC economies (Brazil, Russia, India and China). China and India are growing fast, with annual growth this year-to-date of 12.5 per cent and 16.5 per cent respectively.

India has bounced back from a subdued 2014, and is seeing a strong increase in domestic frequencies, according to IATA, while although China’s growth rate has moderated, it is still on course to add an additional 230 million passenger journeys between 2014 and 2019. This is more than double the other three BRIC nations put together.

Brazil and Russia, by contrast, are struggling. Falling oil and other commodity prices are partly to blame. Economic sanctions have also affected the Russian economy. “It is notable that airlines in Brazil pay some of the highest fuel charges in the world; bringing the country’s fuel policy in line with global standards would certainly be a boost for air transport,” said IATA.

Meanwhile, the prospects for more open travel between the rest of the world and Cuba and Iran offer “exciting possibilities for business, tourism and development” as diplomatic relations warm up, says IATA, with Iran offering the greater potential.

Although Cuba is the largest Caribbean country by population, passenger growth would be from a low base of five million passengers today to around 13 million by 2034, in the best-case scenario. Iran, by contrast, already has a market of 12 million passengers, mostly domestic flyers. If strong GDP growth is accompanied with a full normalisation of international relations and the end to sanctions, the total size of the Iran market could be 43.6 million passengers by 2034, notes IATA.

“There is a great deal of scope for economic development in Cuba and Iran, and air transport can play an enormous role in that. Relative to their economic development, the people of Iran and Cuba fly less than the global average. In Iran, full integration in the global economy could mean a difference in passenger growth of around 13 million extra travellers a year,” said Tyler.

The latest forecast shows China is expected to overtake the United States as the world’s largest passenger market (defined by traffic to, from and within) by 2029. In 2034 China will account for some 1.19 billion passengers, 758 million more than 2014 with an average annual growth rate of 5.2 per cent. Traffic to, from and within the US is expected to grow at an average annual growth rate of 3.1 per cent that will see 1.16 billion passengers by 2034 (523 million more than 2014).

The data shows that India will displace the United Kingdom as the third-largest market in 2026, with Indonesia rising to number five in the world. Japan, Spain, Germany and France fall relative to their competitors, Italy falls out of the top 10, while Brazil moves from 10th place to 7th.

At present, aviation helps sustain 58 million jobs and $2.4 trillion in economic activity. In 20 years’ time, aviation is expected to support around 105 million jobs and $6 trillion in GDP.