Among the fastest growing aviation economies of the current century, Turkey has become a major hub for air transportation. With a significant domestic market, a diversified geography that supports strong business and leisure demand and two major airlines on a growth trajectory, the country’s location on the border of Europe and Asia has enabled it to boost its standing on the world’s connectivity stage.

Even looking back to the start of the Century you couldn’t predict the rapid rise of the country’s aviation sector. In 2000, Istanbul’s largest gateway, Atatürk International was handling less than 10mppa having just opened a new terminal building. Turkish Airlines was one of a number of flag carriers struggling against economic and competitive pressures and closely aligned to the soon to fail Swissair through its Qualiflyer alliance. Pegasus Airlines was a small charter airline and Istanbul’s Sabiha Gökçen International had only just opened to flights.

Fast forward a decade and a half and last year Atatürk International had risen to the eleventh largest airport in the world handling 61.8 million passengers, Sabiha Gökçen was handling a further 28.1 million passengers, Turkish Airlines was the biggest airline in the world by network having grown passenger traffic six-fold and Pegasus Airlines was respected among the low-cost airline elite.

Alongside this change and buoyed by enhanced connectivity, the tourism sector of Turkey now employs around 8% of the total workforce in the country, and accounts for as much as $71 billion of its GDP, a figure the World Travel and Tourism Council had forecasted will rise to $107 billion in 2025, around 12% of total GDP.

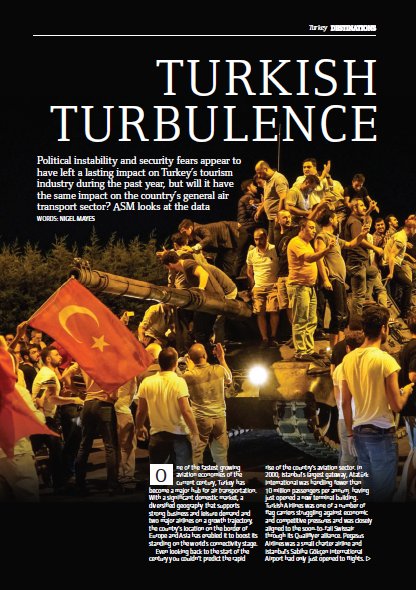

But, just as quickly as things have grown, the environment has changed notably over the past couple of years. Political instability, resumed violence from the PKK Kurdish militants and the Islamic State group, and a president that has been regularly critical of western ways, has changed the climate.

Terrorist attacks have increased in regularity, many targeting foreign visitors, with the June shootings and suicide bombings at Istanbul Atatürk International Airport that killed more than 40 people and injured hundreds having a further direct impact on the industry. A subsequent attempted military coup which saw at least 290 people lose their lives and military tanks on the runway at Atatürk has now resulted in a state of emergency being declared across the nation.

Ahead of the attempted coup Turkey was suffering its deepest tourism decline on record. Tourist arrivals fell 40.9% year-on-year in June, with just 2.44 million people arriving during the month, data from Turkey’s Tourism Ministry showed. It was the biggest drop on record, according to the data, and broke the 34.7% year-on-year decline that was seen in May. In fact it was a eleventh consecutive month that arrivals have fallen, the longest streak of year-on-year declines in statistics that span over a decade.

This is a far cry from the 37 million annual visitors recorded in 2014, which made Turkey the sixth most popular tourist destination in the world. The Russian market has dominated the traffic declines after Turkey downed a Russian fighter jet near the Syrian border last year, sparking a bitter feud between presidents Vladimir Putin and Recep Tayyip Erdogan. This has led to accusations that Turkey are ‘accomplices of terrorists’ from Putin and claims the country have been buying oil from ISIS.

While political officials in Ankara and Moscow have recently started to rebuild ties and charter flights between the countries resumed in July this year, tourist arrivals from Russia dropped 87 percent in the first six months of the year, according to data from the Tourism Ministry.

Another worrying factor that has concerned international tourists is that Turkish borders have been the primary thoroughfare for fighters of all kinds to enter Syria and this has impacted flows from many traditional inbound markets across western Europe, including Germany (down 31.5% in May 2016 versus last year) and the United Kingdom (down 29.4% in May 2016 versus last year), the countries that send the most visitors to Turkey.

Annual figures released by the Turkish Census Bureau indicate that in 2015, tourism revenues in the country dropped 8.3% compared to 2014, from $34.3 billion to $31.5 billion. This year’s declines will have a much bigger impact on the country’s Economy (analysts suggest a $6 billion dent), with President Recep Tayyip Erdogan urging Turkish citizens to take domestic holidays to offset these considerable losses.

The situation in Turkey is fast-changing and its volatility is causing uncertain times across the aviation industry. Turkey is now is state of emergency as the country deals with a coup and numerous terrorist attacks. For the tourism industry this obviously has an immediate impact as people start to question their holiday bookings and consider alternative options.

This will obviously impact passenger demand over the second half of the year. However, traffic data for the first half suggests that while tourist traffic is clearly down, the same assumption isn’t necessarily correct when you look at pre-coup scheduled demand data extracted from AirVision Market Intelligence from Sabre Airline Solutions.

This shows that a 10.2% growth in domestic journeys within Turkey is helping to offset the decline in international passenger numbers, albeit the traffic loss in some foreign country markets is considerable, most notably Russia where demand is down 48.1%. This has seen it fall from the 4th to 13th largest international market in and out of Turkey.

There are also declines in H1 2016 versus H1 2015 demand to/from Belgium (-24.5%), France (-17.4%), Switzerland (-7.9%), Azerbaijan (-7.3%), Spain (-6.6%), USA (-6.1%), Italy (-6.0%), Cyprus (-4.8%), Austria (-4.0%), Netherlands (-3.7%). Although much smaller O&D markets, notable declines in China (-16.2%) and South Korea (-34.8%) highlight why airlines in both countries have scaled back capacity to Turkey in H2 2016.

Some of the larger markets in and out of Turkey remain resilient, however, according to the data. Scheduled demand to and from the UK was up 24.4% in H1 2016 despite travel companies reporting declines across the same period, due to significant capacity growth. Increases in arrivals and departures were also recorded by Ukraine (+51.6%), Germany (+0.9%) and many nations across North Africa, the Middle East and Gulf regions, including Algeria, Iran, Israel, Kuwait, Lebanon, Tunisia and the United Arab Emirates (UAE).

|

Largest country markets for scheduled international passengers in and out of Turkey (H1 2016) |

|||

|

Rank |

Country |

H1 2016 Demand |

% Change (vs H1 2015) |

|

1 |

GERMANY |

5,984,783 |

0.9 |

|

2 |

UNITED KINGDOM |

2,147,292 |

24.4 |

|

3 |

CYPRUS |

1,020,740 |

-4.8 |

|

4 |

NETHERLANDS |

708,436 |

-3.7 |

|

5 |

IRAN |

617,788 |

56.0 |

|

6 |

SWITZERLAND |

615,576 |

-7.9 |

|

7 |

FRANCE |

598,035 |

-17.4 |

|

8 |

ITALY |

584,829 |

-6.0 |

|

9 |

AUSTRIA |

496,585 |

-4.0 |

|

10 |

SAUDI ARABIA |

451,293 |

-0.4 |

|

11 |

USA |

432,097 |

-6.1 |

|

12 |

UKRAINE |

430,364 |

51.6 |

|

13 |

RUSSIA |

415,658 |

-48.1 |

|

14 |

UAE |

336,356 |

1.6 |

|

15 |

SPAIN |

332,521 |

-6.6 |

From a connectivity perspective the decline in demand has led many carriers to cut flights and capacity into Turkey this year. The number of charter flights is down considerably, while in the scheduled market Swiss has closed reservations for winter operation on Zurich – Istanbul and EVA Air and China Southern Airlines have already closed routes into Istanbul from Taipei and Urumqi in the past couple of months.

Elsewhere, Asiana Airlines and Korean Air have cut frequencies on flights between Seoul and Istanbul, Singapore Airlines has reduced its summer schedule on Singapore – Istanbul and Etihad Airways has cancelled plans to upgrade the Abu Dhabi – Istanbul route from an Airbus A321 to a Boeing 787-9.

While it is clear that charter providers, tour operators and those airlines serving the leisure segment are being hit hard by the fall in tourism demand, national carrier Turkish Airlines has become partly insulated from the impact by its hub and spoke model that supplements local demand with connecting passenger flows, now 44% of the carrier traffic at Istanbul Atatürk International Airport. However, this may appear to be just a short-term reprieve and we must await post-coup traffic data before we will fully understand.

Much is made about how the big three Gulf carriers of Emirates Airlines, Etihad Airways and Qatar Airways have changed the ways many people fly by offering new efficient connection options via hubs in Dubai, Abu Dhabi and Doha. But, Turkish Airlines actually serves more destinations in the world than any other carrier and its strong network particularly across Turkey and Europe helps feed traffic to and from flights across Africa, Asia and the Americas.

It is clear that the airline is not immune to Turkey’s crisis. A net loss of 1.24 billion liras ($432 million) in the first three months of the year, the worst quarter performance since under the stewardship of its respected CEO, Temel Kotil, in 2005 and worst result since 1999, highlights this issue and the recent planned coup and declaration of a state of emergency will certainly not help.

However, with an increasing number of its passengers never actually arriving in Turkey but simply transiting at its Istanbul Atatürk International Airport hub from one flight to another (transfer demand was up 22% in the first quarter), the airline’s management team have taken an optimistic stance. This may put pressure on yields, but the airline still expects to post record revenue of $12.2 billion this year, although profits will be well down on last year’s performance.

This is being supported by a continued rise in capacity. Available seat kilometers rose 14.6% to 81.8 billion from the start of the year through to the end of June due to growth in Africa and North America and passenger numbers rose 7.8% in the same period to 25 million. This growth is expected to continue through to the end of the season with capacity planned to rise a further 20% in the second half of 2016.

As at the end of June 2016 the Turkish Airlines fleet had grown by 47 units since the same month last year to 329 aircraft, including 20 additional widebodies. Its network had grown from 276 to 290 destinations at the same time last year. This year the airline has already confirmed planned new flights to Cluj, Denpasar, Phuket, Seychelles and Zanzibar, based on aircraft availability, but plans to fly to Conakry in Guinea now appear to have dropped since Emirates Airline confirmed its return to the African market.

These traffic figures highlight how the Turkish Airlines model is helping through the country’s crisis with international to international transfer passengers increasing 18.5%. Adjusting capacity has enabled domestic demand to rise 8.8% versus the first half of 2015, while a 3.9% growth was recorded in international traffic. Together this has boosted passenger numbers to 30.1 million, up from 28.5 million in the period last year.

While this may be keeping demand up, there are underlying concerns on profitability with load factors slipping by 3.9 percentage points across the six months to 73.7% and international business class passengers falling 5.2% versus the first half of last year.

As this issue closed for press the first signs of how strongly the tourism decline and political instability was impacting the national carrier became clear when it started to load its revised winter 2016/2017 schedules with significant cuts throughout its network, particularly across Europe.

As first revealed by Routesonline’s schedule blog Airlineroute in late August, Turkish Airlines is significantly cutting its winter schedule versus its 2015/2016 offer with frequency cuts across over 50 markets, including the removal of daily rotations into the likes of Baku, Budapest, Copenhagen, Hamburg, Hanover, London Gatwick, Madrid, New York, Rome and Stuttgart. Winter flights have also been cut from Ankara to Berlin, Frankfurt and Vienna; Istanbul Ataturk and Aqaba, Bordeaux, Friedrichshafen, Gassim, Genoa, Ivano-Frankivsk, Karlsruhe/Baden-Baden, Muenster, Osh, Pisa and Rotterdam; and Istanbul Sabiha Gokcen and Baku, Erbil and Venice.

The newly appointed chief executive officer of Pegasus Airlines, Mehmet Nane, believes the airline’s low-fare model has helped it - for now - to overcome the worst of the problems hitting the Turkish market this year. “Despite the challenging conditions of 2016, we are on target to surpass our 2015 guest traffic of 22.3 million to reach over 24 million in 2016,” he said.

“One of our core advantages is our agility which means we are well placed to respond to changing market conditions and continue growing as a network Low-Cost Carrier connecting continents from the North to the South, East to the West,” he added.

The near future of travel and tourism is Turkey looks bleak with economists believing that the country will fail to reach their growth targets in the next two years. The government had forecast a 4.5% GDP growth in 2016, and 5% in 2017, but this has already been revised down to 3.5% and could slip further. We will certainly be looking at the latest data to see what impact ongoing tensions will have through the remainder of the year.

|

This article is modified from an original feature that appeared in... ROUTES NEWS - ISSUE 6, 2016 PLEASE CLICK HERE to view the magazine. |

|