The Beechcraft Bonanza G36 has a 300-hp Continental IO-550-B piston engine that runs on 100LL avgas.

A year and a half after the debut of the Eliminate Aviation Gasoline Lead Emissions (EAGLE) initiative, manufacturers of piston-powered aircraft and engines had an opportunity to comment on its progress and their collective message was: it’s complicated.

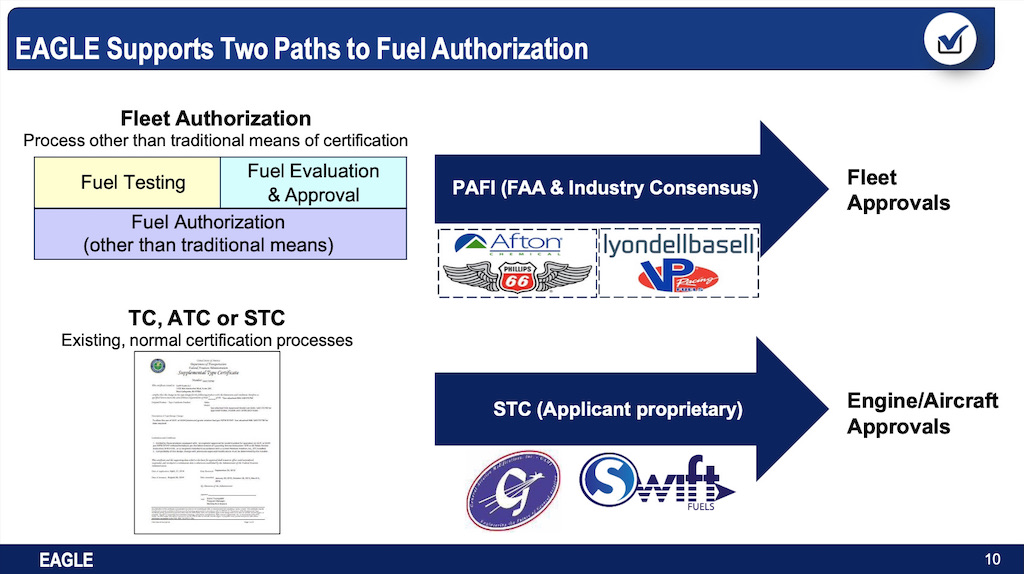

There are four high-octane unleaded fuels being advanced to achieve the EAGLE program goal of eliminating lead emissions from the entirety of the U.S. piston-engine aircraft fleet by 2030. Two fuels are progressing through the Piston Aviation Fuels Initiative (PAFI), an industry-government testing program, and two through the FAA supplemental type certification (STC) process, which is proprietary between the agency and fuel developers.

During an on-line briefing June 5 to update reporters on the status of the EAGLE program and, according to the sponsors, clarify its objectives, engine and aircraft manufacturers said they have not been able to test candidate fuels in sufficient quantities to understand their properties. The discussion also revealed an apparent schism in knowledge between the fuels undergoing the PAFI process and those being approved by STC.

“We’re all excited about this and we’re optimistic it’s going to work, but we have tested nothing to date,” said Textron Aviation President and CEO Ron Draper. “We have been trying to acquire the fuel to test the fuel and have been unable to do so. We can’t endorse or speak good or bad about [a fuel] until we test it and fly the heck out of it.”

Draper said Textron’s Cessna and Beechcraft brands have built 250,000 aircraft over their histories, the majority of which remain in service. It currently has 20 jets and airplanes in production.

Piper Aircraft has built 140,000 aircraft, of which 80,000 are still flying. “The vast majority of them come from the general aviation heyday, which is well over 20 years ago,” said its president and CEO, John Calcagno. “In our case, many flight schools are asking for support from us. We’re also getting questions from insurance companies, financial institutions and everybody associated with the purchase of an aircraft.”

Calcagno added: “The fuel is very different from a traditional change to our aircraft. A wholesale fuel change is not a typical, incremental product improvement. It’s an outside requirement not within our normal span of control through type certificates. Engines are affected, everything where the fuel gets placed is affected.”

Lycoming Engines Senior Vice President Shannon Massey said her company, a Textron subsidiary, holds type certificates for 650 engine models. There are more than 100,000 Lycoming type certificate engines still in the GA aircraft fleet, of which more than half require a higher-octane fuel, as well as Lycoming-powered experimental aircraft that also require high-octane fuel.

“Those are also most of the aircraft in the fleet that are workhorses—they are ferrying supplies to remote locations, they’re patrolling borders, they’re supporting military operations,” Massey said. “The loss of the ability of these airframes to service society would definitely be impactful.”

Octane rating is just one measure to consider in a fuel; other factors include materials compatibility, stability, density, flow rate, vaporization and producibility, Massey said. “We want to ensure [an engine] with whichever fuel is being used, is within the safety margins that we’ve tested and certified,” she explained. “We need to ensure, whether it’s through the PAFI authorization process or via the STC process, that we have a good understanding and knowledge of what specific tests and which models of engines are evaluated so we can stand behind that portion of it.”

EPA Endangerment Finding

General aviation trade associations and the FAA unveiled the EAGLE initiative in February 2022, although the program was conceived in late 2021, sponsors say. Looming in the background, the U.S. Environmental Protection Agency (EPA) announced a draft finding in October 2022 and expects to issue a final determination this year that lead emissions from piston-engine aircraft that operate on leaded fuel endanger public health. Once that happens, the EPA will formulate a new regulation governing lead emissions from aircraft.

GA trade associations are also defending against a trend of local communities pressuring small airports to ultimately close for various reasons. In late 2021, supervisors in Santa Clara County, California, moved to ban the supply of 100 Low Lead (100LL) at two county-owned airports after a study revealed elevated blood-lead levels in children living near Reid-Hillview Airport in San Jose.

The most common type of avgas, blue-dyed 100LL contains the fuel additive tetra-ethyl-lead, which is used to boost its octane rating, or ability to resist detonation or “knocking,” in high-compression piston engines.

“EAGLE has a clear goal and a mandate to eliminate lead in aviation fuel no later than 2030 and hopefully sooner,” said Aircraft Owners and Pilots Association (AOPA) President and CEO Mark Baker, who co-chairs the initiative. “It’s important that this unleaded transition be safe and smart [and that] local airports and airport sponsors provide a supply of 100LL during the transition for those aircraft that need higher-octane fuel to safely fly. We’re pushing back on those airports and communities that are prematurely banning 100 Low Lead before a replacement of unleaded fuel is widely available.”

Last September, the FAA granted broad approved model list STC authorization to one of the two STC pathway fuels—General Aviation Modification Inc.’s (GAMI) G100UL—allowing its use in nearly all piston aircraft as a drop-in replacement for 100LL avgas. The agency expects to authorize a second unleaded fuel through the STC process—Swift Fuels’ 100R—later this year for a limited set of aircraft.

Owners can apply to GAMI for STCs to use G100UL for their specific aircraft and engine. GAMI co-founder George Braly tells BCA that he has arranged with a blending company in Houston to produce the high-octane unleaded fuel and approached avgas suppliers Avfuel, Epic, Titan and World Fuel Services to send rail cars there to load it. Cirrus Aircraft and Robinson Helicopter are testing the GAMI unleaded fuel and engine manufacturers have been offered supplies if they sign non-disclosure agreements.

GAMI started work on G100UL in 2009 and opted not to participate in the PAFI program when the latter effort formed in 2013-14. Had it joined the industry-government collaboration, GAMI would have been required to start over with its certification process, Braly has said.

The company’s maverick status and the STC fuel pathway more generally appear to have complicated the industry’s transition roadmap for high-octane unleaded fuel, which draws on specifications developed by standards organization ASTM.

“We’ve been at this a long time,” Pete Bunce, General Aviation Manufacturers Association president and CEO, told the press briefing. “When we formed PAFI back in the last decade, we set the parameters to be able to look at the corner cases and to have fuels come in and go against the testing criteria that all the associations developed, whether it’s for rotorcraft or fixed-wing aircraft, to be safe.”

The “transparency” of fuel attributes has been key for manufacturers, Bunce said. “For a century now, we’ve been designing, then testing, then certifying aircraft and engines,” he related.

“The paramount rule in this is that they are safe and we have to prove that to the FAA. The way we have done this is we have had known fuels…[that] we have been able to certify and test against this standard and that standard has been given to us by ASTM. It’s been a fuel standard that has been out there and developed and everyone has had confidence because there is a consensus process to provide that fuel. We’re into new territory now.”

Rob Hackman, Experimental Aircraft Association vice president for government affairs, said more information has been disseminated to engine and aircraft original equipment manufacturers (OEM) through the PAFI program. “The two [developers] that are in the PAFI program have supplied significant amounts of fuel to be tested in that program,” he said. “A lot of that testing was either done by the FAA at the Tech Center or by the OEMs through in-kind agreements. Those OEMs that are participating in the program have had insight into those fuels.”

Hackman added: “The challenge of not being able to see or have visibility into the fuels comes a little bit more from the STC side, where the STC program, by its nature, is proprietary between the FAA and the applicant. Both the components in the fuel are proprietary but also the certification program that’s used to [achieve] the STC.”

The PAFI Pathway

The partnerships of Afton Chemical-Phillips 66 and LyondellBasell-VP Racing are advancing candidate fuels through the PAFI program. Testing procedures and results are shared with the companies participating in PAFI, said Lirio Lui, executive director of the FAA Aircraft Certification Service. When a fuel successfully completes the testing regime, the FAA will issue a fleetwide authorization, allowing its use in aircraft.

“Both teams have completed extensive testing,” said Lui, who co-chairs the EAGLE program with AOPA’s Baker. “They have fine-tuned their fuel formulations based on some feedback and they are in the final initial phase of testing, with the LyondellBasell fuel at the [FAA] Tech Center. Testing for the Afton-Phillips 66 fuel will begin shortly at one of our engine manufacturing facilities. Things are really moving along under the PAFI umbrella.”

The FAA plans to authorize the use of low-octane UL91 unleaded fuel later this year through the fleet authorization process. The release of UL91, which should work across 68% of the piston-engine aircraft fleet, “will facilitate broader-use experience with the transition” to a higher-octane unleaded fuel, Lui said.

The agency allows for two types of standards in certifying fuels—ASTM’s as well an independent standard, Lui said. “Historically, aviation fuel has been sold kind of as a commodity that is produced by various stakeholders to the industry standards,” she advised. “In recognizing that some fuel developers choose to control the production of the fuel that they develop, an independent specification provides a similar path while keeping the information concerning the fuel under the control of the developer.”

In response to a BCA inquiry, LyondellBasell, a Netherlands-based chemical company with U.S. operations in Houston, said its team continues to work with the FAA, manufacturers and other industry parties through the PAFI program to develop a drop-in replacement unleaded fuel for 100LL. In parallel, it is conducting ASTM testing to develop an industry fuel quality and performance specification.

“We have developed several fuels with the required detonation resistance for most GA aircraft engines and are continuing to fine-tune these products to ensure the final fuel selection meets all quality and performance requirements for a safe, reliable and cost-effective deployment,” LyondellBasell said.

“The FAA has resumed engine testing on our fuel, and we expect full-scale testing will begin sometime in the second half of 2023,” the company said. “The PAFI testing program will be completed well in advance of the anticipated phase-out of leaded avgas, which is likely years away.”