ViaSat-3 Americas, the first terabit-class communications satellite, launched aboard a Falcon Heavy rocket from Kennedy Space Center on April 30, more than a year later than planned.

The recent European Business Aviation Convention & Exhibition (EBACE) in Geneva presented service providers with a platform to report progress—and for the industry to take stock—of a promised new wave of in-flight connectivity (IFC) that is still gathering.

Still awaiting closure during EBACE was Viasat’s $7.3 billion acquisition of London-based Inmarsat, which the companies first announced in November 2021. The marriage of the two major legacy providers of satellite communications was delayed when the UK Competition and Markets Authority (CMA) initially withheld approval over monopoly concerns. U.S.-based Viasat announced the completion of the transaction on May 31.

During the regulatory review period, Viasat had expected to deploy the first of three, new-generation, high-capacity Ka-band satellites in the first quarter of 2022. ViaSat-3 Americas, the first terabit-class communications satellite, finally launched aboard a SpaceX Falcon Heavy rocket from Kennedy Space Center, Florida, on April 30, more than a year later than planned.

After an extended review by an independent panel, the CMA approved the Viasat-Inmarsat merger in early May. “The evidence analyzed by the panel shows that, while Viasat and Inmarsat compete closely—specifically in the supply of satellite connectivity for Wi-Fi on flights—the deal does not substantially reduce competition for services provided on flights used by UK customers,” the authority stated. “The evidence also shows that the satellite sector is expanding rapidly—a trend that is set to continue for the foreseeable future. This is due to increased demand for satellite connectivity, driven largely by the ever growing use of the internet by business and consumers.”

The CMA specifically mentioned OneWeb and SpaceX Starlink, new constellations offering Ku-band service from low Earth orbit (LEO) satellites. The authority noted partnerships OneWeb struck last year with equipment supplier Panasonic Avionics and geostationary (GEO) satellite operator Intelsat, both focused on marketing to airlines, as well as Starlink’s launch contract with airBaltic. OneWeb deployed a last batch of 36 satellites via launch provider NewSpace India into space in March, completing construction of its 618-satellite LEO constellation.

New Branding And New Antenna

At EBACE last year, air-to-ground (ATG) network operator Gogo Business Aviation announced partnerships with OneWeb for satellite connectivity and with Hughes Network Systems for a new flat-panel electronically steered antenna (ESA) to track OneWeb’s spacecraft. At this year’s conference, Gogo christened its launch product in the LEO satcom space as “Gogo Galileo” after the famed Italian astronomer and unveiled a second ESA form factor designed for larger aircraft, manufactured by Hughes.

IFC service and equipment provider Satcom Direct (SD) has also partnered with OneWeb and Germany’s QEST to develop a flat-panel ESA antenna. In February, SD announced the entry into service of its mechanically steered, tail-mounted Plane Simple antenna system after two years of development and testing. Twenty-one aircraft participating in evaluations of the Ku-band version of the Plane Simple system, which connects with Intelsat’s FlexExec broadband service, were transitioned to customer status. SD is also developing a Plane Simple antenna for Inmarsat’s Jet ConneX Ka-band service.

As of this spring, SpaceX had launched more than 4,000 Starlink satellites into orbit. Aircraft connect to Starlink via a top-mounted Aero Terminal ESA antenna. In early May, charter operator JSX announced that it completed installing Starlink terminals across its fleet of 40 Embraer regional jets. SpaceX has said that supplemental type certifications are in development to fit Starlink on Gulfstream, Dassault, Bombardier, Beechcraft, Cessna and Embraer models.

Other Notable Developments

Among other notable, recent developments in the satcom connectivity space:

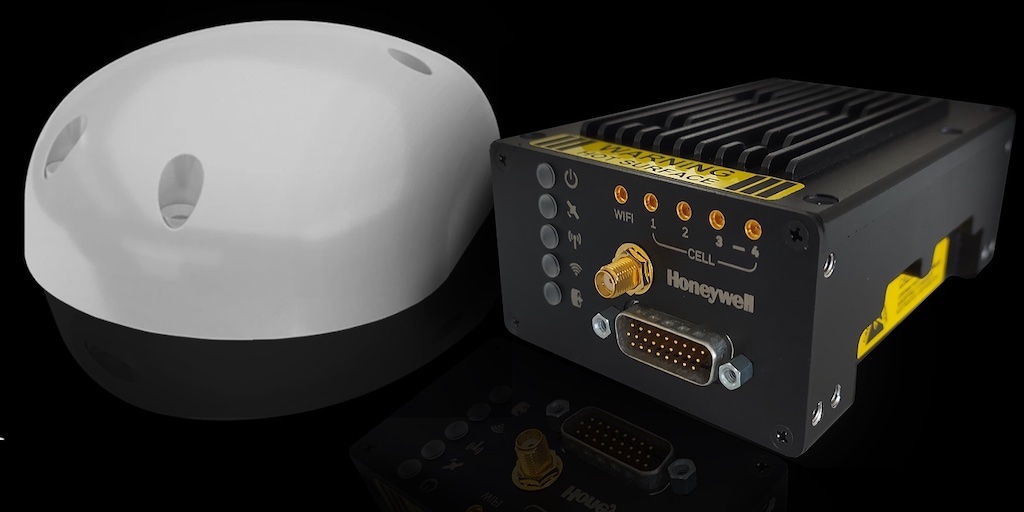

- Honeywell announced at EBACE that its Aspire 350 satcom hardware has been certified by satellite operator Iridium to transmit and receive the latter’s high-speed Certus L-band voice and data service. Honeywell is a value-added manufacturer of Certus terminals.

- Honeywell also recently announced VersaWave, a new satcom and 5G shipset for advanced air mobility and uncrewed aircraft systems. The VersaWave terminal connects with Inmarsat’s SwiftBroadband L-band system when outside of cellular coverage.

- Bombardier said May 5 that new Challenger 3500s will come with Iridium Certus L-band connectivity as a baseline feature, making the 3500 the first super midsize business jet so equipped. Collins Aerospace will supply its new IRT NX SATCOM system with high-gain antenna for reception.

- Inmarsat named Collins as a distribution partner for its new SwiftJet L-band connectivity service, expanding their existing partnership. A product of Inmarsat’s Elera network upgrade that is set to enter service this year, SwiftJet will be six times faster than SwiftBroadband, the company says.

- A third supplier, Israel-based Orbit Communications, will provide next-generation terminals for Inmarsat’s Jet ConneX Ka-band service, with Honeywell and Satcom Direct. Orbit has developed the AirTRx series of satcom terminals consisting of two line replaceable units. Jet Connex, launched in 2016 using Honeywell-made JetWave terminals has been activated on 1,400 business jets.

Ground-Based Connectivity

Providers of ATG broadband communications have kept pace with the developments in space. North Carolina-based SmartSky Networks announced in July 2022 that its 4G/5G technology network for business aviation was operational across the continental U.S.

SmartSky's service milestone preempted rival Gogo Business Aviation, which completed its own nationwide 5G ground infrastructure in October 2022 and expects to launch service in the fourth quarter. The companies are locked in an ongoing patent-infringement lawsuit that SmartSky filed in February 2022, alleging that Gogo’s system draws from some of its inventions.

During an NBAA News Hour webcast in April, SmartSky executives described new ways to share and exploit data via the company’s “Skytelligence” platform, which accepts third-party application programming interface connections, and an Aircraft Interface Device (AID) avionics unit. An AID can connect multiple data sources and gather data from the aircraft’s engines and systems.

“Moving data and getting it off the aircraft is where this technology comes into play,” said Sean Reilly, SmartSky Networks vice president for air transport and digital solutions. “We can actually route this data directly to the backend, and the company’s IT department can manage all the data to and from that aircraft.”

“[It’s] not just a cabin Wi-Fi experience—it’s beyond that,” Reilly added. “It’s really moving all of this data with our partners, our network, our patented technology, to be able to build a faster path to a differentiated experience.”

Responding to a question, Rich Pilock, SmartSky vice president of product management, said the company does not plan to integrate satellite communications as Gogo is doing. “Our position has always been that we’re very complementary of satellite service, [and] typically less expensive for the air time,” Pilock said. “If you’re an operator who is flying 75% of the time domestically and 25% internationally, I think the combination of a satellite system with an air-to-ground system has always made sense.”

Once the UK competition authority signed off on Viasat’s acquisition of Inmarsat on May 9, approvals by the U.S. Federal Communications Commission and European Commission followed on May 19 and May 25, respectively. The companies are now cleared to build the multi-band, multi-orbit space and terrestrial network they spoke of in 2021.

“You can imagine that on Day 1, we’ll be gearing up to innovate and find creative new approaches to bring to customers,” Kai Tang, Inmarsat head of business aviation, told BCA.