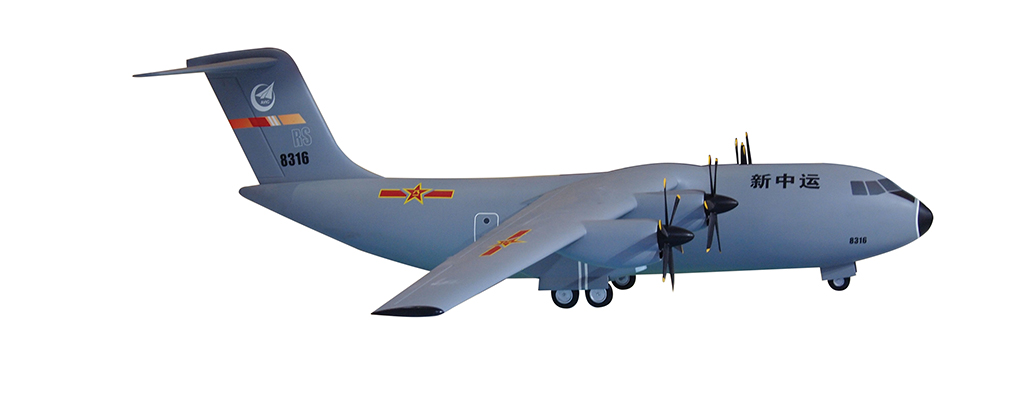

The Y-20 program has shifted from the early design (pictured) powered by D-30KP-2 engines to a high-bypass WS-20 engine.

The Avic Xian Y-20 program will transform China’s airlifter and tanker capabilities over the coming decade, as production pushes the combined fleet of the type toward 200 aircraft.

Among the most important strategic results will be marked strengthening of China’s ability to project airpower well beyond the first island chain, toward Guam and U.S. naval forces in the Western Pacific.

- The indigenous type will displace old Soviet designs

- WS-20 engine performance is crucial

The other main prospective change in the Chinese transport-tanker fleet over the coming decade will be diminishing numbers for the two designs that the Y-20 is replacing, according to a new Aviation Week Network assessment led by Senior Defense Analyst Anna Sliwon-Stewart (see chart). The Ilyushin Il-76 airlifter and refueling versions of the Xian H-6 bomber will disappear.

A further buildup in the collection of Y-9 propeller-driven airlifters from Avic’s Shaanxi works is forecast, but with no sign of the needed replacement type.

An airliner type will likely be required to replace Boeing 737s used as military VIP transports. The obvious choice would be the Comac C919.

In all these developments, the key component is the Y-20 program, which has just made the important shift to a high-bypass engine—the WS-20 from the Shenyang establishment of the Aero Engine Corp. of China. Including 10 prototypes, the air force now has 67 Y-20s, according to the Aviation Week assessment. The initial airlifter production version is the Y-20A, and its successor with the new engine is presumed to be the Y-20B. Corresponding tanker versions are the YY-20A and presumably the YY-20B.

Production of all versions this year will probably total nine, a reduction from last year’s 15, while the factories switch to the WS-20 versions. Noting that the U.S. formerly judged that an economical rate for the Boeing C-17 was no less than one per month, Aviation Week Network Senior Program Analyst Matt Jouppi suggests that such a rate is reasonably likely for the Y-20, too. But for the early 2030s, he forecasts a step up to 13-14 a year.

Conceivably, production could be pushed a little faster to build a radar air-surveillance version, if one appears. Avic spoke this year about the potential of the type for such missions. Public promotion by the group of a possible military design normally indicates a lack of funding. But the usefulness of an air-surveillance Y-20 version is obvious, since China has no other fully indigenous jet design that could carry both a large radar for the mission and a crew of operators.

As for the tanking role, no airlifter is an ideal choice, since off-loadable fuel capacity will suffer from the weight and drag of a fuselage that is unnecessarily large for the mission.

The Chinese Air Force is probably not complaining about that design compromise, however, because the YY-20A and forthcoming YY-20B must be several times more capable than their predecessors as China’s main tanker types, the H-6DU and H-6U.

Those predecessor designs are based on the twin-engine H-6 bomber, a version of the Tupolev Tu-16. They retain its single-shaft WP-8 turbojet, development of which began in the late 1940s. The engine was crude even by the standards of 60 years ago.

The gross weight of the H-6DU and H-6U is around 80 metric tons (180,000 lb.), very low for a land-based tanker. And no more than half of that mass is likely to be available for fuel, much of which would be guzzled by the inefficient engines rather than off-loaded, especially if the mission station were far from base.

By contrast, the Y-20 has a gross weight of 180-200 metric tons, similar to the Boeing KC-46 Pegasus, and its tanker version should be able to carry at least 80 metric tons of fuel. Moreover, even the YY-20A, like the Y-20A, uses a turbofan—the Russian Saturn D-30KP-2, with a bypass ratio of around 2.4. And now the Y-20B has appeared with the WS-20, which probably has a bypass ratio of 5-6, offering even lower fuel burn.

The WS-20’s performance is indeed a critical issue for the Y-20. Industry sources in China said in 2014 that the engine in its state of development at the time was crude, having perhaps the technical level of an early-version CFM56, such as the CFM56-3 of the Boeing 737-300 (AW&ST Dec. 1-8, 2014, p. 22). But program managers were planning improvements, including fitting the engine’s production version with a fan based on that of the CFM56-5, bringing the greater efficiency of wide-chord blades.

Thrust of 33,000 lb. was required from the WS-20 for the Y-20, one industry source said then. That output may be associated with an ultimate gross weight exceeding 200 metric tons, a figure cited by Chinese military academics when the type made its initial flight in 2013. If the WS-20 has not yet reached 33,000 lb. in its production version, further development of the Y-20 could be in the offing.

Whatever its current output, the apparent introduction of the engine on a production Y-20 in the past year or so implies its design is now reliable. Still, foreign intelligence agencies will no doubt be monitoring the growing fleet of Y-20Bs—and soon YY-20Bs—to see how much time they are actually spending in the air.

Since the H-6 versions have been such feeble tankers, the availability of YY-20s, even those with D-30KP-2s, is dramatically improving China’s ability to project airpower into the Western Pacific. The air force’s interest in doing so has long been apparent from its preference for big fighters with large internal fuel capacity for operating more than 1,000 km (600 mi.) from China’s coast. Moreover, such missions fit closely with the country’s strategy of denying U.S. access to its Pacific approaches.

For example, those big fighters now will be more capable of escorting strike aircraft toward Japanese bases, Guam and U.S. naval task forces. They will also be more able to conduct long-range strikes themselves and set up distant barriers against U.S. bombers and cruise missiles. Bombers and maritime patrollers will benefit as well.

Aviation Week estimates that YY-20A production is winding up with the delivery of an eighth aircraft and that six YY-20Bs will be built annually for the rest of the decade, picking up to eight a year beginning in 2030. The tanker version is forecast to take slight priority over the airlifter.

The Y-20A airlifter fleet is now complete at 48 aircraft, according to Aviation Week’s assessment, and Xian Aircraft can be expected to deliver six Y-20Bs a year for the next decade. Notably, YY-20s appear to be adaptable to airlift configuration by the removal of fuel pallets.

As YY-20s flow into the fleet, retirement of the 18 H-6DUs and H-6Us will surely proceed. The last is likely to disappear in 2032, Aviation Week estimates. The forecast retirement time frame for bomber H-6s with the WP-8 engine is similar.

The removal of China’s 27 Il-76s from service is also expected by 2032, with three units of the type’s tanker version, the Il-78, departing a year earlier. One benefit would be avoiding dependence on Russian spare parts and technical support. “China wants to be done with relying on Russia,” Sliwon-Stewart says.

In retrospect, China’s sequence of airlifter development looks quite rational. Its first step was to greatly improve the Y-8, a local version of the Antonov An-12, to create the Y-9, which, with a gross weight of 65 metric tons, is comparable to the Lockheed Martin C-130 Hercules.

Although the Y-8 fleet is declining, Shaanxi Aircraft is forecast to keep building eight Y-9s a year until 2028, when 103 should be in service.

The second step in airlifter development has been the much larger effort to create the Y-20, which Sliwon-Stewart notes not only provides the basis of a much-needed tanker but also has an airlift capacity that well suits missions for invading Taiwan. For example, a Y-20 can carry a tank.

Unexpectedly, there is no sign of an obvious third step: development of a Y-9 replacement. Shaanxi Aircraft in 2014 promoted a suitable concept called the Y-30 (AW&ST Nov. 17, 2014, p. 40). It had a gross weight of about 80 metric tons and four turboprop engines, with twin turbofans considered as an alternative. Officials said the Y-30 would not only be generally more modern than the Y-9; it also would specifically address the problem of that type’s awkwardly narrow body.

Since not all missions need a Y-20, the air force must still require an aircraft in the Y-30 category. Likely explanations for the Y-30’s nonappearance are challenges in developing engines and a shortage of engineering capacity in an industry that is busy working on other military aircraft designs.

The Chinese military uses Boeing 737s, Airbus A320s and Bombardier/MHIRJ CRJs for transporting senior officers (see chart). Western governments quietly acquiesce in it doing so. As the 737s retire, 10 new airliners will be required for the mission, Aviation Week estimates. If Western governments continue to turn a blind eye, the chosen type should be the C919, even though it is full of foreign systems and is powered by CFM International Leap engines.

China would surely be pushing its luck if it tried to use the C919 for more overtly military missions such as surveillance.

The air force does not operate the country’s most prestigious VIP aircraft—those that transport President Xi Jinping and senior ministers. They are instead operated by Air China and are painted to look like airliners.