Why Boeing’s CEO Says He’s Playing the Long Game

Boeing expects that its Wisk air-taxi venture, which recently became a wholly owned subsidiary of Boeing, will help teach the FAA how to certify autonomous aircraft.

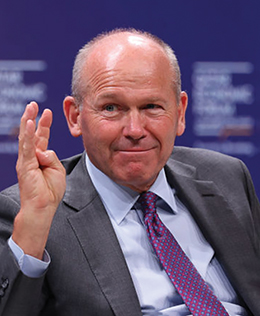

Boeing CEO David Calhoun sat down with Aviation Week editors Joe Anselmo, Guy Norris and Sean Broderick at the company’s Commercial Airplanes delivery center in Seattle. Excerpts from their wide-ranging conversation—some of which can be heard on an accompanying Check 6 podcast—follow.

- No timetable on next airplane launch

- India, Middle East opportunities “not nirvana, but pretty close”

- The promise of AI to speed certifications

AW&ST: There is a lot of confusion about what “nothing before 2035” means. When is the earliest Boeing could launch a new clean-sheet airplane development and when is the earliest it could enter service? Everybody would like a timetable, but that’s not really how major airplane programs can or should be developed. I have been clear that we need something that delivers in the neighborhood of a 20-30% improvement over today’s airplanes. That is what will justify airlines making a move. These programs have got to be designed to last 50 years; 20 or 30 years is a disaster. The notion that we should be looking at niche opportunities or competitive dynamics over a short period of time—when you’re going to invest tens of billions of dollars in a program for 50 years—is just silly. I would rather invest in capabilities that, when we package them together, will meet that objective. I don’t have a timeline for the maturity of those capabilities. I am very comfortable that the package of technologies we’re working on is going to add a lot of value to whatever that airplane is going to be. I just don’t know when they will mature.

Airbus’ CEO told us he is aiming to replace the A320neo family with a next-generation airplane as early as 2035 (page 46). But that would still be more than a quarter--century since either Airbus or Boeing launched a clean-sheet airliner. Does that open the door for a dark horse to challenge the duopoly? You don’t get a dark horse in this space at this scale in 10 years. Not even close. The player that is ultimately going to make a difference and become the third competitor is China. They’re going to be good. And then three players are going to be battling it out for a very long period of time. And what’s wrong with that? Three players competing in a gigantic global market is good for everybody. But the notion that somebody is going to get ahead of my competitor or us between now and 2035—I wish him luck.

You seem to be warming to the transonic truss-braced wing (TTBW) as a potential for the next single-aisle. You’ve said you need a 20-30% fuel-burn improvement, and NASA has suggested TTBW will get perhaps 9%. That leaves an awful lot for the engine to do. We’re going to learn a lot in this [TTBW flight test with NASA in 2028]. The concept works in a wind tunnel, but until it flies on an airplane, you don’t know. I think it is sound. I’m optimistic that something derived from this experience is going to give our propulsion players a bigger window to get to the finish line with us. Those couple of years heading into ’28 will be very important as we mature and understand what it really does.

One of the criticisms of the TTBW is that the length of its fuselage makes it much harder to adapt to hydrogen propulsion. If I thought hydrogen was going to make a meaningful difference in 25 years, that would be a consideration. But I’m not sure that’s going to happen—not on the scale of airplanes we’re talking about. We believe in hydrogen, but it is a long way away.

You’ve said Boeing’s next commercial airplane will introduce a new level of autonomy. What does that actually mean? Over the next 20-30 years, the primary incentive for autonomy is safety. Human error is the biggest hurdle for us to get to the end game, which is no accidents, ever. The biggest and most important contribution to safety is going to be the rollout of autonomy.

When we talk about autonomous capability, the first thing pilots say is: “That sounds like they want to take one or maybe both of us out of the cockpit.” Here’s the words I would use: That is possible. That is not our motivation.

Wisk, the autonomous air-taxi venture in which Boeing just took a controlling interest, has been a pathfinder for autonomy and electric propulsion. I have enormous confidence in the airplane, but the most important dimension for Boeing and the industry is going to be teaching the FAA how to certify autonomy. The airplane, the ground systems, it’s all got to be foolproof. They’re starting to move down that path, and they have an application to respond to. My philosophy is to let Wisk behave as a wholly owned company within Boeing. Whatever you need, you get. That exchange teaches us entrepreneurship, which big, regulated companies are horrible at. And they have the benefit of our regulatory experience.

Speaking of the FAA, the 737-7 certification timeline has expanded beyond what anybody expected. What gives Boeing the confidence it can deliver programs already in the pipeline—the 737-10, 777-9 and 777-8 freighter—on the schedules you’ve promised customers? With the -7, it’s the documentation, the design assurance steps that the post-MAX world requires. I could battle all day long and say it’s cumbersome, but it is what it is. I’m confident that we will get to the finish line. And the -10 will then, in my view, move at a more accelerated pace. I hope that when we get through the -7 and the -10 and the [new] 777 that Boeing and our regulator will collectively learn how to refine those processes to make them easier, faster and smarter.

The 737-8 is the sweet spot in your MAX lineup. Airbus is looking hard at launching a stretch A220-500, potentially with a GE engine as an option. Does it worry you that they could use that to come at the -8? Nope, not a bit. We can compete with it head-on. If my competitor wants to do that, it’s going to steal a decent amount of their resources. And when do you think it will be introduced? Right about the time we’re all revamping the whole product line. Why would you do that?

The 787 has experienced a big set of mostly little issues. How much of those are related to being the first mover on composites and other cutting-edge technologies versus execution missteps? I think most of it relates to the very tight envelope on the 787 design. You go into all of the fuselage development and the processes by which we assemble and join those pieces, and we used lots of shims. Did we have process disciplines in our supply chain that would ensure these shims were placed precisely and met the spec? It’s been a lot of little things, none of which have compromised safety. But in today’s strict conformance world, you’ve got to fix it. I can’t stand when I get a new shim problem—and I hope we never see another one, but if we do, we’ll fix it, conform and learn from it.

Sustainable aviation fuel (SAF) has been identified as key to reaching the airline industry’s target of net-zero emissions by 2050. It seems Boeing is frustrated by the lack of progress in ramping up SAF production. Between now and 2050, it’s the only chance we have, and we all know it. Our Cascade tool measures pretty much every engine every day and tells us exactly what the emissions levels are. It is meant to be an industry tool that informs policymakers on the pace at which we think we can get there. And my hope is we can synchronize this across the industry. This is the only answer, and we must get there.

You’ve said a handful of parts can cause bottlenecks in the supply chain. Do you see opportunities for Boeing to bring more design and manufacturing in house? Yes. We have a big fabrication operation that has bailed us out on many of these constraints. The step change on that occurs with the next airplane. I look at the 787, and Boeing was focused on capital-light. I want to move back the other way and control more of the vertical [integration] and intellectual property. How far we get down that spectrum I don’t know, but it will be a very different objective from the 787.

During a recent media briefing in South Carolina, you said: “Life will be OK without China.” Does that mean Boeing doesn’t have to get back to 2018 sales levels there? This is a supply-constrained industry. When you get backlogs that go out 7-8 years, there is no one market that gives you some big advantage. We intend to win in China. I was exhausted by investors worried about whether we would be in business without China. So I said, “Here’s our company without it,” and I gave them all the forecasting data on that basis. And if we get it, things will be even better. We’re entirely focused on getting it.

Is part of that because India is emerging as such a force in demand for commercial airplanes? What I see going on in India reminds me of the early buildout in China. In Air India, you finally have a carrier that is going to be capable of competing in the international market. They inherited a broken-down, dilapidated airline, but this company has all the capital in the world. I pretty much guarantee you they’re going to get to the point where they can compete with Emirates and Qatar [Airways] and all the other players that have been taking their market. In the meantime, all that domestic travel is going to continue to build out. Their airport development programs are going to pick up. Never like China, but the market’s going to be huge.

India also is becoming an engineering center for Boeing, both in commercial and defense. I think they’re going to be a key ingredient to shoring up the supply chain across the industry, and most definitely for Boeing.

And providing a design capability as well? Without a doubt. We have a vertical fin out there that was built on a digital model they developed. It simplified a whole bunch of stuff, and it’s more productive. The thing that excites me the most isn’t the cost or capability of their production; it’s the model development stuff. And they’re just as hungry as can be. There aren’t many other places that offer that kind of capability.

Boeing also won $37 billion worth of orders at list prices from Saudi Arabia this year. A trillion dollars is going into making the kingdom a new destination. They put in a new airline, Riyadh Air. Wait until you see the brand attached to that. Saudia has gone out there with a big order, and my guess is they’ll start another one, because they know what is required to get 100 million people to visit Saudi Arabia, and they have a little bit of money. So you have the kingdom and India going on. Do you think the [United Arab Emirates] is going to sit around and let them take back everything? They’re going to run the play as hard as they can, and they’ve got a whole new fleet of [Airbus] A380s they have to replace. It’s the most inefficient airplane in the air. So it’s a hot market. It’s not nirvana, but it’s pretty close.

The T-7 military trainer has been held up as the poster child for Boeing’s foundational work toward model-based system engineering, and yet that program has issues. Does that mean you still have a long way to go to reach the level of engineering needed for your next--generation commercial airplane? When [U.S. Air Force] Secretary [Frank] Kendall says the T-7 is about 20% better than we hoped, that is music to my ears because model-based engineering is a learning curve. Every mistake you make informs the model, and it gets better and smarter. The T-7 learning experience for us has been profound. It’s the beginning. It reminds me of the days of ceramic matrix composites. I hope someday you’ll take an angle on ChatGPT, generative [artificial intelligence] and what they can do for certifications. If I have a clear and reliable set of design practices, I can begin to use this in the certification process, trained on a database that is secure and trusted. Someday, everything gets faster. And the productivity inherent in that is massive.

It’s a scary thought, though. It’s very scary unless you control it. And you can. You can train on trusted sources.

How much is Boeing willing to invest to make the Starliner reusable space capsule operational? Given that SpaceX is so far ahead now with its crewed vehicle, why even bother? We’re going to do whatever NASA asks us to do. We’re going to compete for it. If we win, great, and if we don’t, we’ll deal with it. We do believe in it, and there has to be more than one player. So we’re not shutting the door on it. We intend to do it and make money on it, but we’re going to let the market and our customer let that play out. In space in general, we still have the most powerful rocket that has ever left this planet. I know others are trying, and they get a lot of publicity, but they’re a long way from there. We’ve had to be very selective, and building out a big presence in low Earth orbit is not going to be our No. 1 focus. And we’re going to continue to work with our defense customer in the most classified of worlds. It helps protect the country in every way, and it may end up being the most important capability of all.