DALLAS--The cargo aircraft conversion market is surging and expected to climb even higher, but the sector faces numerous headwinds as it seeks to meet rising demand.

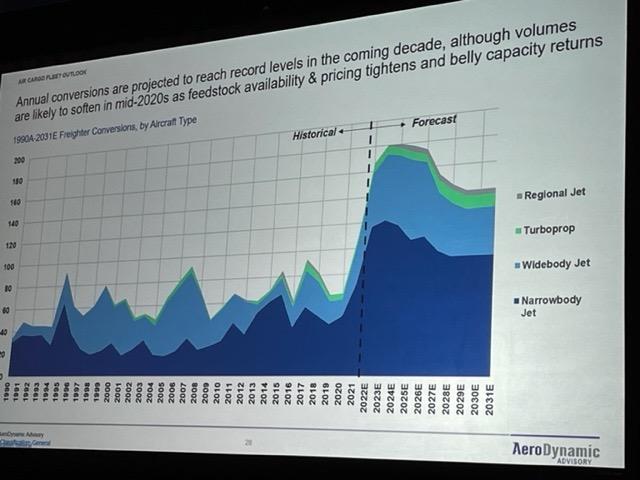

“Last year was a record for freighter conversions with about 110, and we still see upside,” said Mike Stengel, a senior associate at AeroDynamic Advisory and moderator of a panel on cargo conversions at Aviation Week’s MRO Americas show. His firm is forecasting that conversations will more than double, from about 80 a year before the COVID-19 crisis to 180 by the middle of the decade, before easing back to 140 annually by the end of the 2020s.

GA Telesis President and CEO Abdol Moabery attributes the increased demand to the Amazon effect. “You can order a product in London and get it the next day from the U.S.,” he said, adding that such demand is evolving the fastest in China, where companies have installed lockers so employees can have their purchases delivered at work. “I don’t think we’re going to [return to] a period like 2018-19 when dedicated cargo planes were struggling,” he said.

But the booming market still faces a number of challenges. Among them:

*Competition with passenger demand for popular aircraft, such as the Airbus A320 family. “The A321 is going to be a fantastic freighter program,” said Moabery. But it’s also a fantastic passenger airplane. That’s the problem.”

*The end of many years of ultra-low interest rates, which makes covering the cost of financing more challenging.

*Longer lead times for materials, such as tooling required for conversions, due to bottlenecks in the global supply chain. “We sent one set of tooling via sea but then airlifted [a backup] because we didn’t know when the sea freight was going to arrive,” said Mike Perkins, senior director of engineering, logistics and technical services at ST Engineering.

*Workforce challenges that are rippling across aerospace and MRO. Robert Convey, SVP of sales and marketing at Aeronautical Engineers, Inc., said his company has been forced to look to Eastern Europe for sheet metal workers. “We just don’t have enough bodies, and the young kids aren’t going in this direction,” he said.

Meanwhile, a slower recovery in international travel is keeping widebody aircraft grounded, depressing cargo capacity. “Every other day you see another international route being re-instated,” said Tim Scott, SVP-technical at aviation consulting firm Avitas. “But we’re not gong to get back to 2019 international levels until 2024.”

Yet another challenge for some cargo operators are new restrictions preventing them from overflying Russia. That can add hours to some flights and reduce optimal cargo capacity.

There are also some silver linings. Scott noted that the value of Boeing 777-300ERs was already coming down before the COVID-19 crisis decimated demand for widebody aircraft. “That actually helps conversions,” he said.