Air India Joining Star Alliance to Hasten Country’s Invigoration, says OAG

Air India’s forthcoming membership of Star Alliance will be a welcome start to the Bharatiya Janata Party’s (BJP) governmental term, according to aviation intelligence expert OAG. As the BJP’s new Prime Minister Narendra Modi promises to revive economic growth in India, Air India’s new position will improve India’s connectivity to high-growth economies and give Star Alliance members access to India’s vibrant domestic air market.

“With a population of 1.2 billion and an economy projected to grow by 5% this year, India is a market which international airlines have yet to penetrate,” said John Grant, executive vice president, OAG. “Successful integration of Air India into Star Alliance will require some tweaking of schedules but the network benefits look set to work for India’s flag carrier and a good number of the alliance’s members.”

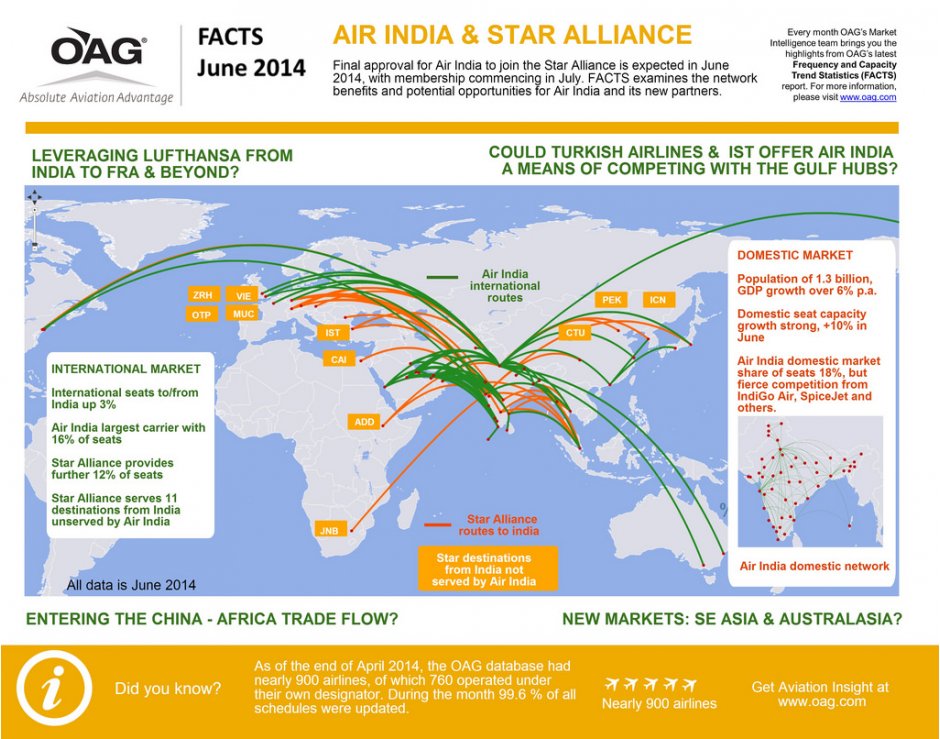

According to OAG, India’s international capacity is growing at a steady rate of three per cent. In June 2014, Air India and Star Alliance carriers collectively provide 28 per cent of India’s international capacity. Air India currently operates to 33 international destinations with a focus on the Middle East (54 per cent of seats) and Europe (12 per cent of seats). Joining Star Alliance potentially adds eleven unserved international destinations to Air India’s network: two of these are in China, three in Africa (where Air India does not currently operate) and five in Europe.

“As India is arguably better placed geographically than the Gulf region as a connecting point for the emerging traffic flows between China and Africa, as it is close to the Great Circle Route, effective scheduling between Star Alliance members Ethiopian Airlines, South African Airways and Air China might see some of this traffic shift to Mumbai and Delhi routings,” explained Grant.

Turkish Airlines, a Star Alliance member, will potentially provide Air India access to a well-placed network and one-stop connectivity across Europe, North Africa and even into sub-Saharan Africa, according to OAG. This should improve Air India’s ability to compete with the ‘big three’ gulf carriers (Emirates, Qatar and Etihad) which now contribute 16 per cent of India’s international capacity, it adds.

Emirates currently operates 20 per cent of seats between India and the Middle East and Air India’s share is 18 per cent, according to OAG’s latest FACTS (Frequency and Capacity Trend Statistics) report. Much of this capacity serves the booming Indian migrant labour market which provides workers across a range of Middle East countries. In June 2014 there are 1.1 million airlines seats between India and the Middle East each way, and an average of 182 flights each day in each direction, according to filed schedules for the month.

These show that only ten per cent of Air India’s seat capacity in June 2014 is to South East Asia, specifically Bangkok, Singapore and Yangon. Through Star Alliance member Thai Airways, Air India will be able to access Australia, Indonesia, China and Japan.

India’s domestic market is experiencing strong capacity growth in June 2014, up ten per cent on June 2013, according to OAG. Air India accounts for 18 per cent of India’s domestic capacity and is the third largest carrier after IndiGo Air and SpiceJet, its monthly FACTS report highlights.

Air India’s comprehensive domestic network will be attractive to Star Alliance’s international carriers such as Lufthansa, South African Airways and Air China, as they seek to expand their reach into the Indian subcontinent, claims Grant.

International air services connecting to Air India’s domestic operations will provide access to much of India. For Lufthansa, the lead member of Star Alliance, Air India offers a chance to re-engage with the Indian market having lost market share of India-Europe traffic to the Gulf carriers. The five routes that Lufthansa flies between India and its Frankfurt and Munich hubs connect Indian’s domestic market with Lufthansa’s vast network.

“Final approval for Air India to join Star Alliance is expected in June and membership should commence in July,” said Grant. “The network benefits for both Air India and Star Alliance members are strong, however Air India will face strong domestic competition from rival domestic carriers IndiGo, SpiceJet and Jet Airways. Competition will also intensify as and when AirAsia India and Tata-Singapore Airlines enter the fray in the coming months.”

OAG’s analysis of the merger of Air India joining Star Alliance is outlined in OAG’s FACTS report for June 2014. You can see a summary of the report, below, or can download the full report here.