There is a strong tradition of two dominant carriers in the Canadian market. Air Canada and Canadian were the mainstays in the 1980s and 1990s. More recently, Air Canada has been joined by WestJet.

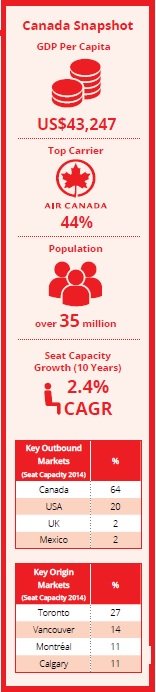

It appears that “three is a crowd” in the Canadian aviation market, with the other carriers taking a smaller share of the seats. Capacity overview Canada is the 15th largest country market in terms of O&D passengers and the market has seen seat capacity grow steadily over the last ten years at an average rate of 2.4% CAGR.

Air Canada and WestJet operate a combined 68.3% of the seats in the Canadian market. WestJet has steadily eroded Air Canada’s market share with an increase of seven percentage points in seat capacity over the last ten years from 17.1% to 24.4%, while Air Canada’s share of seats has fallen from 46.8% to 43.9%, a three percentage point fall.

Relative newcomer, Porter Airlines, captured 4.2% of seats in 2014 despite only starting operations in 2006 and only flying Q400s from Billy Bishop Toronto City Airport. Air Transat and Sunwing are the 4th and 5th largest carriers with 2.3% and 1.8% market share respectively.

The vast majority of seat capacity from Canada is to either another Canadian destination (63.9%) or to the US (19.6%), with only 16.5% of seats to points outside of these markets. The next largest countries served are the UK, Mexico and Cuba, reflecting Canada’s close ties to the UK and the desire for sunshine during the cold winter months.

Interestingly, France is only 7th after Germany, a result of Air Canada feeding the Star Alliance hubs at Frankfurt and Munich, although the majority of the traffic will be for onward points across the Lufthansa network.

The Canadian outbound leisure market is very seasonal, with a strong summer flow to Europe and a strong winter market to Florida, Mexico and the Caribbean. Indeed, Canada is a good market for Europe charter capacity where aircraft from both Thomson and Thomas Cook switch across to Canada during the winter months. Toronto is by far the largest source of traffic and accounts for 26.6% of the seats in the Canadian market, while Vancouver, Montréal and Calgary account for 13.5%, 10.6% and 10.5% respectively. These four markets account for two thirds of the total Canadian capacity.

New business models

The two dominant scheduled carriers have segmented the market through sub-brands. Air Canada launched a low-cost subsidiary, Air Canada rouge, on 1 July, 2013. The rouge fleet has grown to 29 planes and the stated target is 50 aircraft. The carrier uses A319s and B767-300s, both of which have higher density seating than the same aircraft at Air Canada.

Air Canada rouge was designed to enable the parent airline to compete more effectively in lower yielding leisure markets by operating at a lower seat cost. In addition to its higher density seating and lack of a business class cabin, rouge also has its own pilots and flight attendants. The end result is that unit costs at rouge are more competitive with carriers such as Air Transat, and are substantially lower than those at Air Canada. In November 2014, the airline reported that costs per ASM on the rouge 319s are 23% lower than Air Canada while the767 costs were 30% lower.

WestJet launched their Q400 operation, branded as WestJet Encore, in June 2013. Encore was designed to provide feeder services to WestJet, and to enable WestJet to compete with Air Canada Jazz in the country’s regional markets where their 737s were too large, such as Brandon, Nanaimo, Fort St-John, Terrace and Penticton.

But both rouge and WestJet face competition. Canada Jetlines is a new carrier that plans to start operating in 2015 using five leased B737s. The airline will be based in Vancouver and predicts base fares 30%- 40% lower than those of Air Canada and WestJet. The airline is in the midst of an IPO designed to raise C$50 million.

Network changes

In 2014, WestJet entered the transatlantic market for the first time, operating a 737 service between St-John’s Newfoundland and Dublin. A second route, Halifax to Glasgow, is scheduled to launch in 2015. Because of the range limits of the B737, transatlantic opportunities are limited as the aircraft cannot operate direct to Europe from Toronto or Montréal. However, WestJet is scheduled to receive four B767-300s in 2015.

Although the company plans to deploy these planes on flights to Hawaii, it has said it is considering ordering additional widebodies in the coming years. With the addition of the Q400sin 2013 and the planned addition of widebodies this year, WestJet appears to be moving away from a traditional LCC business model to become more of a network carrier.

The launch of rouge added new international destinations to Air Canada’s network, such as Nice, Lisbon, Venice, Edinburgh and Manchester. In addition, Tokyo-Haneda, Milan, Panama City and Rio de Janeiro took their place on the Air Canada network last year. In 2015, Air Canada will add Dubai and Delhi as well as Austin, Texas (all from Toronto). Air Canada has been successful over the past several years at capturing an increasing share of sixth freedom traffic between the US and Europe and Asia via their Toronto hub.

Over the past ten years, passenger volumes in these markets have more than doubled, from 473 passengers per day each way in 2005 to over 1,100 in 2014.

Canada Snapshot

Future World

The Canadian market has grown steadily over the last ten years and hasn’t witnessed the volatility of other country markets around the world. The market continues to be dominated by two carriers. The pure leisure carriers (Air Transat and Sunwing) remain an important, but relatively small part of the overall market.

So what’s next for the Canadian market? New carriers have emerged in recent years. Porter Airlines has carved out a niche in Billy Bishop Airport, where they own the terminal. The carrier wants to sell the airport terminal infrastructure to raise funds to expand their operations with CSeries jets, but may not be able to compete without the protection of a capacity-constrained airport like Billy Bishop.

New leisure carriers like Enerjet have entered the market using 737 on charters for the oil industry and tour operators and even providing capacity for Air Transat, serving thinner markets. If they remain as a leisure carrier, however, it is difficult to see how they can compete on a large scale with WestJet and any future overseas LCC capacity.

It is more likely that WestJet will become a stronger second carrier in Canada with a more robust long-haul network targeting key leisure markets in Europe and developing connecting flows through Toronto. As WestJet’s business model gravitates towards that of Air Canada, there may be room for a new LCC to fill the void. Canada Jetlines may be able to do this but it will take time. For now, two will remain company and three will still be a crowd!