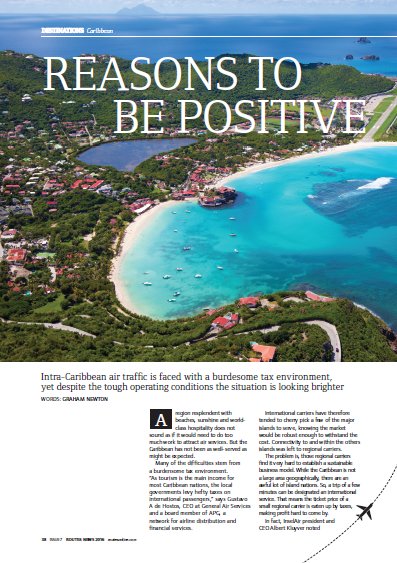

A region resplendent with beaches, sunshine and worldclass hospitality does not sound as if it would need to do too much work to attract air services. But the Caribbean has not been as well-served as might be expected.

Many of the difficulties stem from a burdensome tax environment. “As tourism is the main income for most Caribbean nations, the local governments levy hefty taxes on international passengers,” says Gustavo A de Hostos, CEO at General Air Services and a board member of APG, a network for airline distribution and financial services.

International carriers have therefore tended to cherry pick a few of the major islands to serve, knowing the market would be robust enough to withstand the cost. Connectivity to and within the others islands was left to regional carriers.

The problem is, those regional carriers find it very hard to establish a sustainable business model. While the Caribbean is not a large area geographically, there are an awful lot of island nations. So, a trip of a few minutes can be designated an international service. That means the ticket price of a small regional carrier is eaten up by taxes, making profit hard to come by.

In fact, InselAir president and CEO Albert Kluyver noted recently that intra-Caribbean traffic is the only major market where air traffic has declined in the past 10 years. However, a region so blessed by natural splendour does not easily give in to doom and gloom.

Despite the tough operating environment, InselAir and other regional carriers, such as the resurrected PAWA Dominicana, have been performing well and have grown their networks. The Dominican airline has just begun flights from Santa Domingo to Miami using an MD-83, the US gateway joining eight Caribbean routes on the airline’s route map.

InselAir flies Fokker 50s and Fokker 70s – giving it a reach of about three hours to places like Ecuador and Miami – but is looking to serve longer-haul destinations in South America.

Combining its regional services with international flights is the platform for success. InselAir has interline agreements with almost all airlines that fly into Curaçao, meaning the seamless integration gives a real boost for passengers connecting longhaul destinations with smaller islands.

A virtuous cycle is being created. Good regional networks encourage international airlines to be more adventurous in their own outlook. As de Hostos puts it: “Intra-Caribbean traffic is critical to the success of a multi-destination strategy and feeding large intercontinental aircraft.”

Several other elements are feeding into an increasingly successful equation. Perhaps most notably, a general relaxation of visa requirements is boosting Caribbean air traffic. Several Caribbean nations – Dominica, Grenada, St Lucia, St Vincent and the Grenadines, and Trinidad and Tobago – reached a deal with the European Union and the Schengen region for visa waivers, for example, adding to the freedom enjoyed by UK and Irish citizens.

Other G20 countries have followed suit. “And as visas are eliminated for Dominicans, Jamaicans and Cubans, three of the most populous island nations, intra-Caribbean traffic is increasing,” says de Hostos. That translates into plenty of opportunities for new air service.

The General Air Services CEO points to another critical element in today’s troubled geopolitics. “The fact that the region is considered safe by most G20 citizens continues to be an important external driver,” he says. Mixing safety with sun, sea and sand is a magnet for many global travellers and should not be underestimated in the modern era.

Of course, safety cannot be the only card played and Caribbean countries are working hard to attract visitors, both on an individual basis and collectively. The cruise business is critical and many of the islands are spending lavishly on improving port services and interconnectivity with flights to make the fly-cruise option as painless as possible for passengers.

“All local governments are spending more and more funds on promoting tourism,” agrees de Hostos. He estimates the cruise business is a major driver for the 5-10% increase being seen in international air traffic to the Caribbean year-on-year.

The Caribbean Tourism Organization (CTO) is one of a number of entities pushing at the boundaries of marketing, working on the precept that free-spending governments will generate even more freespending tourists. Its aviation task force (ATF) states that it “accepts that air access is integral to the archipelago’s tourism growth and there is a need to increase access to the international and regional markets, increase economic benefits generated by growth and development of tourism and improve the region’s competitive position in the market place”.

Aside from detailed presentations to regional policy makers and aviation personnel, the CTO-ATF has been active in various disciplines related to improving air service and increasing tourism numbers. This includes technical input to the revision of the Caribbean Community (CARICOM) multi-lateral air services agreement, drafting a proposed new common embarkation / disembarkation card for CARICOM member countries and creating airline negotiation guidelines and related procedures for CTO member countries.

It has additionally formed a highly focused Aviation Committee to facilitate air transportation into and throughout the Caribbean and to enhance airlift. Infrastructure must also keep pace with developments. Poor airport facilities previously buttressed the wall of taxation that regional carriers found hard to deal with but, again, there are grounds for optimism.

St Lucia is due to announce details of the development of Hewanorra International Airport, the main international gateway to the island, under a public-private partnership agreement. Antigua and Curaçao are among many others that either already have undertaken or have plans for, capacity and service quality improvements.

Meanwhile, Princess Juliana International Airport in St Maarten has introduced six self-service eGates for departing passengers. The project has been implemented in combination with the Immigration and Border Protection Services, a department within the Ministry of Justice of St Maarten.

The department’s claim that it is committed to the “modernisation of airport processes” illustrates the growing awareness of authorities to the challenges and potential benefit of air transport in the region. The eGates, supplied by Vision- Box, are integrated with common-use infrastructure of the airport to offer a fast but accurate security control procedure.

Elsewhere, Aruba’s air traffic continues to grow. InselAir remains a major player but a notable feature of the forthcoming season is an expansion in the US market. A total of 16,800 additional seats in 2016 to the island out of the North American region equates to about 4% growth in capacity.

American Airlines has already added a third daily service to Miami while JetBlue has added extra flights out of Boston and New York (JFK). Both services will use JetBlue’s Airbus A321premium Mint experience aircraft.

Meanwhile, Delta Air Lines has upgauged its Atlanta–Aruba route to a Boeing 767-400 from a Boeing 737-900. The new aircraft will operate between December 17, 2016, and March 25, 2017, an overall 12% increase in Delta’s Aruba portfolio. United Airlines is also adding 11% capacity out of Newark, a combination of additional weekly services and larger aircraft during peak days. The Canadian market sees the greatest expansion, a growth of 24% translates to 5,665 additional seats on 25 additional flights.

“The airport is constantly working on improving its efficiency and service to the growing passenger count,” says James Fazio, CEO of the airport authority. “With each forecast we are convinced that our effort to further develop and expand the airport facility is urgently needed.”

Queen Beatrix International Airport last completed a major renovation more than decade ago, adding both an international and a US-bound passenger building. More recently, it has revamped the look and feel of the airport, bringing the warmth of the Caribbean into the terminal through colours and textures.

Any new airport development will doubtless take advantage of improved passenger processing and security. Aruba Happy Flow started in May 2015, a combined effort of the government of Aruba, the local airport, KLM, the Schiphol Group and Vision-Box.

Once a passenger’s e-passport is authenticated and matched to the person holding the document, process information is stored in a personal data envelope. This single biometric token is then used at each additional touchpoint, including bag drop, border/access control and boarding.

Waiting times are reduced, infrastructure use can be optimised and the real-time data generated enables dynamic support of the airport process and passenger flow for all stakeholders involved.

All in all, it may be that Caribbean governments are finally awakening to the fact that the owning a slice of paradise is not enough to secure a healthy and sustainable aviation industry. Taxation remains an issue and the regional carriers are still vulnerable. InselAir has a lot of money tied up in blocked funds in Venezuela, hurting its cash flow, while PAWA Domincana has yet to encounter any real turbulence snce ibirth. But there is good cause to be positive. In the Caribbean, it’s hard to be anything else.

|

This article is modified from an original feature that appeared in... ROUTES NEWS - ISSUE 7, 2016 PLEASE CLICK HERE to view the magazine. |

|