Daily Memo: Asia-Pacific MRO Operators See Contrasting Recovery Trajectories

One of the notable aspects of the COVID-19 crisis in the Asia-Pacific region is that airlines have been affected differently depending on their home market and business model.

The same is true in the region’s MRO industry, where businesses—and lines of work within companies—are suffering to widely varying degrees.

While many companies are experiencing sharp reductions in their primary demand, others have reported only minor change, and a few have even increased their workload. This is driven by favorable geographical location in some cases, and it also depends on what sector of the MRO industry they occupy. Aviation Week’s recent MRO Southeast Asia online event provided some good examples of this diverse range of experiences.

Singapore-headquartered ST Engineering has seen a drop-off particularly in areas such as engine and component MRO, said Yip Hin Meng, the company’s head of commercial aviation asset management. Reduced utilization has meant shop visits have been reduced or pushed back, he said.

Airlines are also looking to defer or reduce the scope of work in these areas—where possible—to preserve cash, Yip said. This could create pent-up demand for engine shop visits for MRO companies.

However, airframe maintenance has not declined much, and there has been a strong demand for freighter conversions. “So we have these different demands in parts of our business,” he said. “And we do have the flexibility in terms of our employment contracts to manage this variation in work.”

Yip said he is hopeful there will be a pickup in overall MRO activity in the third and fourth quarters of this year.

Australia’s Heston MRO does not expect to see a major recovery in demand until October or November, CEO Asta Zirlyte said. Heston was severely affected by the pandemic, she said. The company relied heavily on line maintenance work for overseas airlines, which dropped sharply when international services were suspended.

By the end of March 2020 most of the Heston staff had been stood down. “We needed to react fast,” Zirlyte said. “Then we took a breath, and [said] what do we do now?”

Because it is a small organization, Heston was able to make decisions and change quickly, Zirlyte said. The company switched its focus to lessors, cargo operations, aircraft storage, some base maintenance, and domestic airline line maintenance. Heston also followed its customers as they began operating more cargo flights, which in some cases required the company to obtain new approvals.

Many of these areas were part of Heston’s long-term strategy but were accelerated due to the COVID-19 crisis, Zirlyte said. The aim of this new work is to compensate at least partly for the loss of the international line maintenance business. “It’s not the same, but it helps,” and gives the company “better survival prospects,” she said.

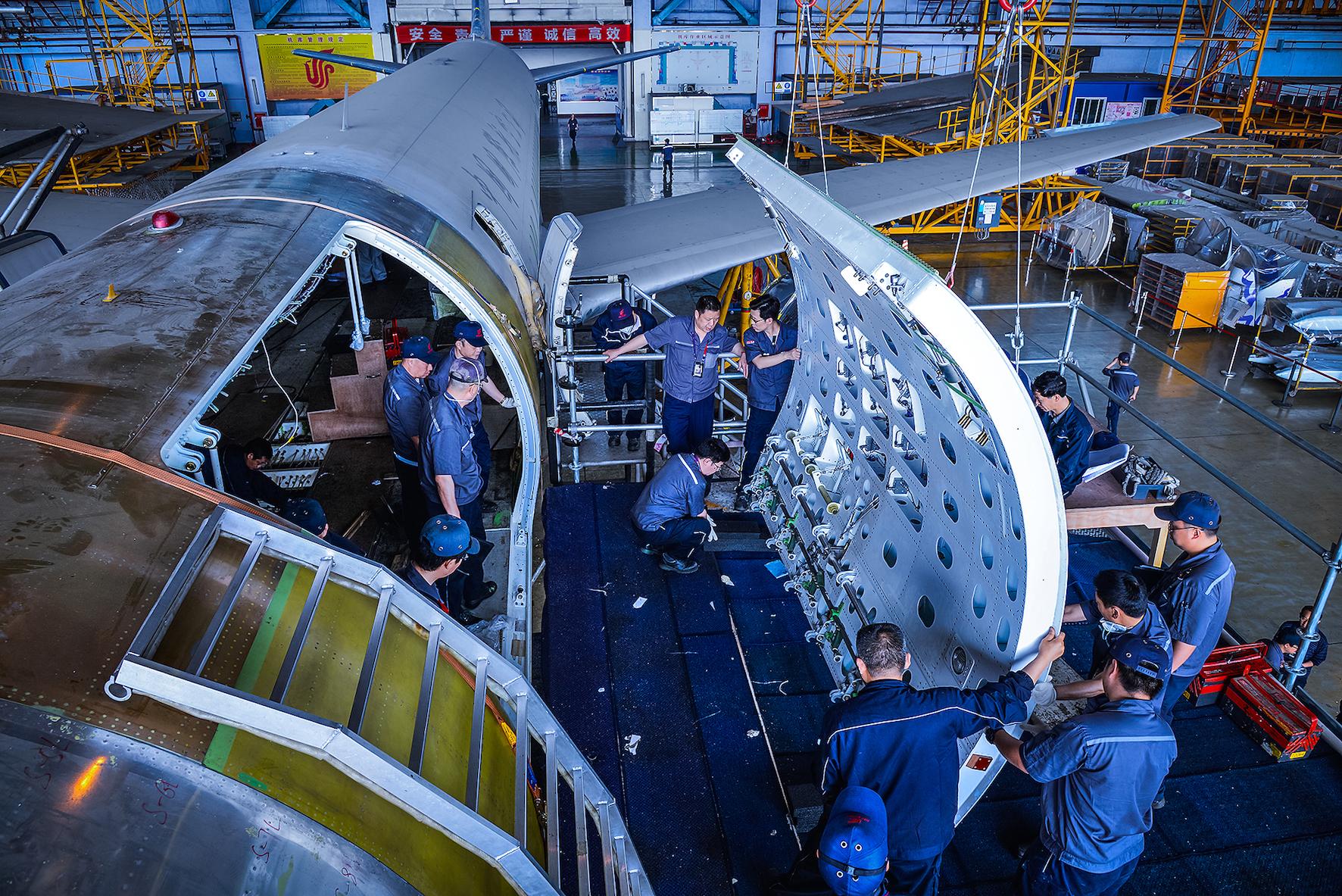

China-based Ameco is one MRO company whose business has not been affected much by the pandemic, said Bernd Meyer, deputy general manager for the company’s Chengdu branch. Base and line maintenance did drop in the second quarter of 2020 when many aircraft in China were grounded. But airframe and engine work continued, and demand rebounded quite quickly as Chinese carriers restored most of their domestic operations.

The Chinese MRO market will probably see a small downward trend in 2021, but should fully recover within a year or two, Meyer said. He predicts airline capacity in China will return to growth mode.

Ameco’s infrastructure expansion plans may be slowed a little by the pandemic, but will still be pursued, Meyer said. He noted that Ameco has no choice but to grow its facilities because its major shareholder Air China intends to dramatically increase its fleet size over the next decade.

Alliance Airlines in Australia is a rare example of a company that has expanded its MRO operations during the COVID-19 crisis.

When the pandemic first hit, Alliance had to downsize to protect the business, said Toby Koch, Alliance general manager for engineering. However, the company found its operations “getting very busy very quickly,” so it had to scale back up again.

Alliance has been “a bit different” in that it has picked up additional work while others have contracted, Koch said. This has included charter work for the mining industry and others, and the carrier has also signed deals to purchase a new fleet of Embraer E190s. To help support the new aircraft, Alliance bought Australian MRO operation Toll Aviation Engineering in November 2020.

“So there’s been a strong element of growth ... on the operational side and the MRO side,” said Koch. “We’re quite lucky, [since] we are one of the few in that situation.”